How to do Futures Trading on WOO X

What are Perpetual Futures Contracts?

A futures contract is a legally binding agreement between two parties to buy or sell an asset at a predetermined price and date in the future.

Perpetual futures contracts, a subtype of derivatives, enable traders to speculate on the future price of an underlying asset without actually owning it. Unlike regular futures contracts with set expiration dates, perpetual futures contracts do not expire. Traders can maintain their positions for as long as they desire, allowing them to capitalize on long-term market trends and potentially earn substantial profits. Additionally, perpetual futures contracts often feature unique elements like funding rates, which help align their price with the underlying asset.

One distinctive aspect of perpetual futures is the absence of settlement periods. Traders can keep a position open for as long as they have sufficient margin, without being bound by any contract expiry time. For instance, if you purchase a BTC/USDT perpetual contract at $60,000 there is no obligation to close the trade by a specific date. You have the flexibility to secure your profit or cut losses at your discretion. It’s worth noting that trading perpetual futures is not allowed in the U.S., although it constitutes a substantial portion of global cryptocurrency trading.

While perpetual futures contracts offer a valuable tool for gaining exposure to cryptocurrency markets, it’s essential to acknowledge the associated risks and exercise caution when engaging in such trading activities.

How to Activate WOO X Futures?

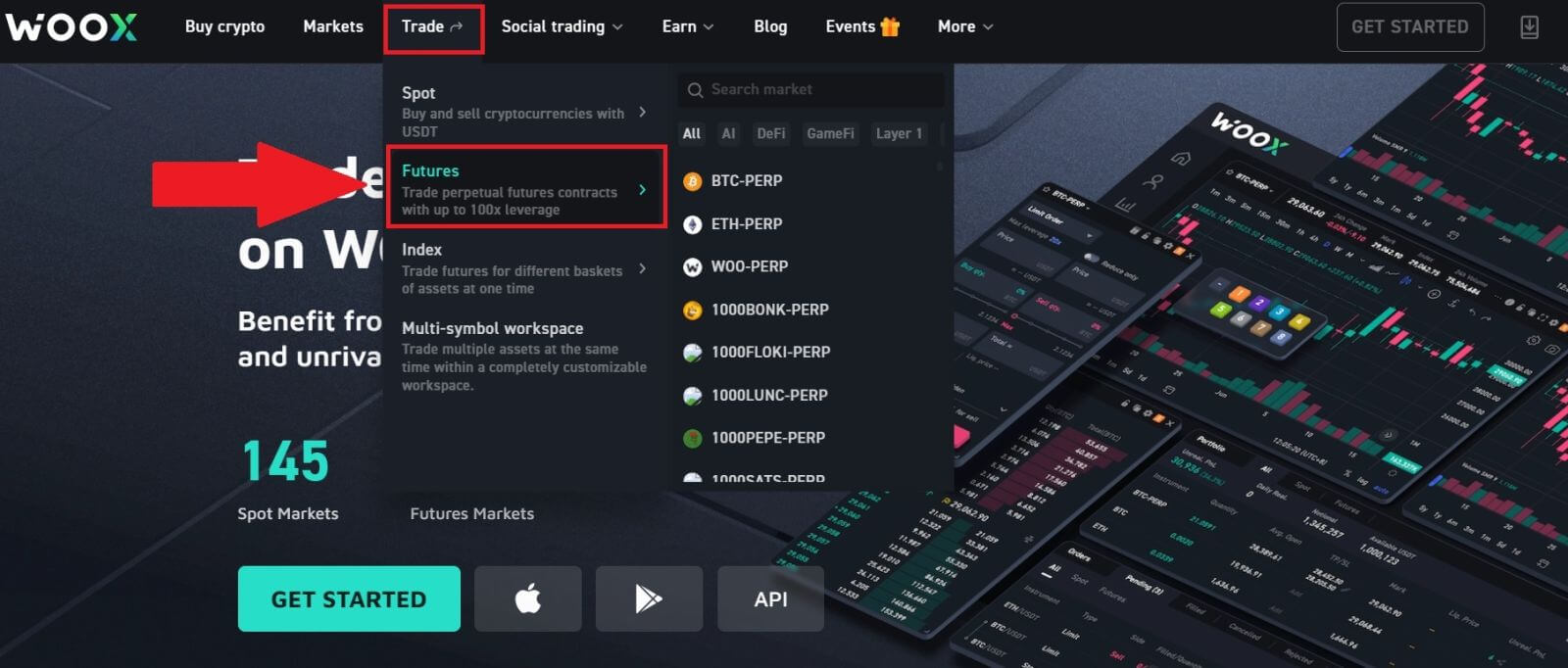

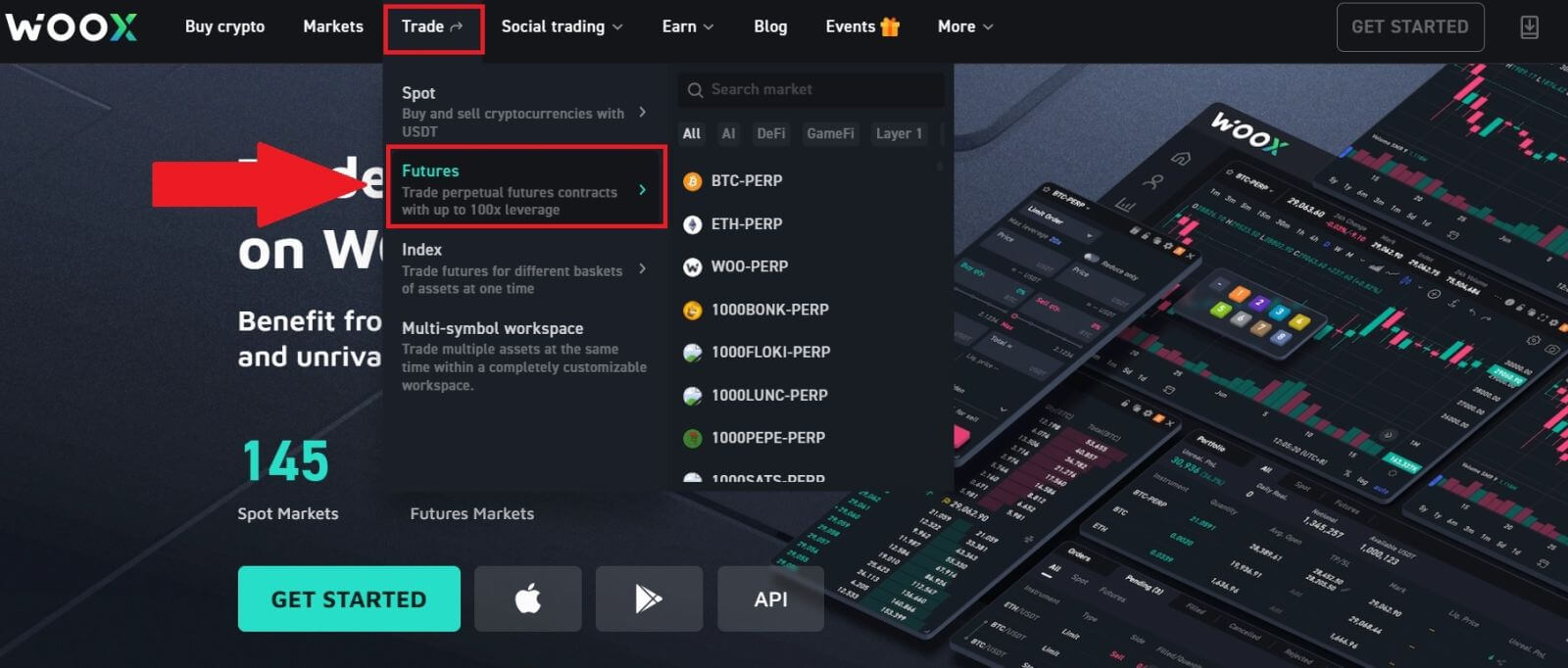

1. Open the WOO X website, click on [Trade], and select [Future].

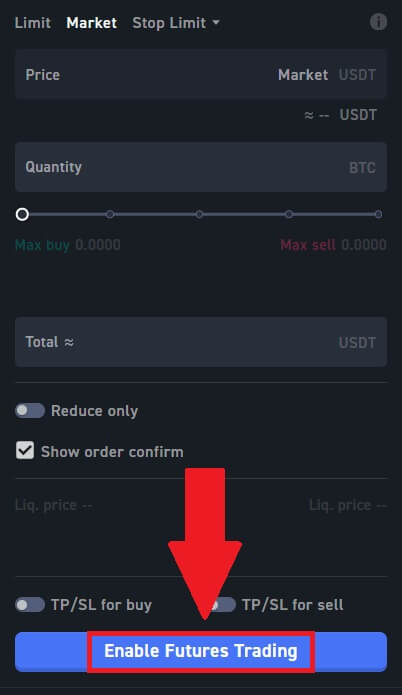

2. If you have not yet activated Futures trading, click [Enable Futures Trading] on the right-hand side of the futures trading page.

2. If you have not yet activated Futures trading, click [Enable Futures Trading] on the right-hand side of the futures trading page.

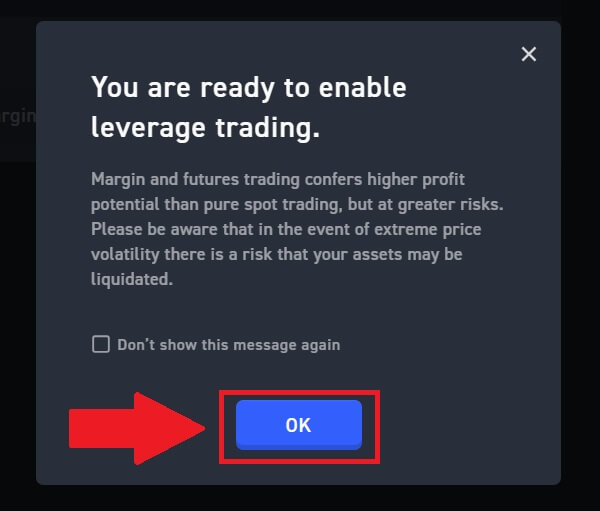

3. Click [OK] to continue the process.

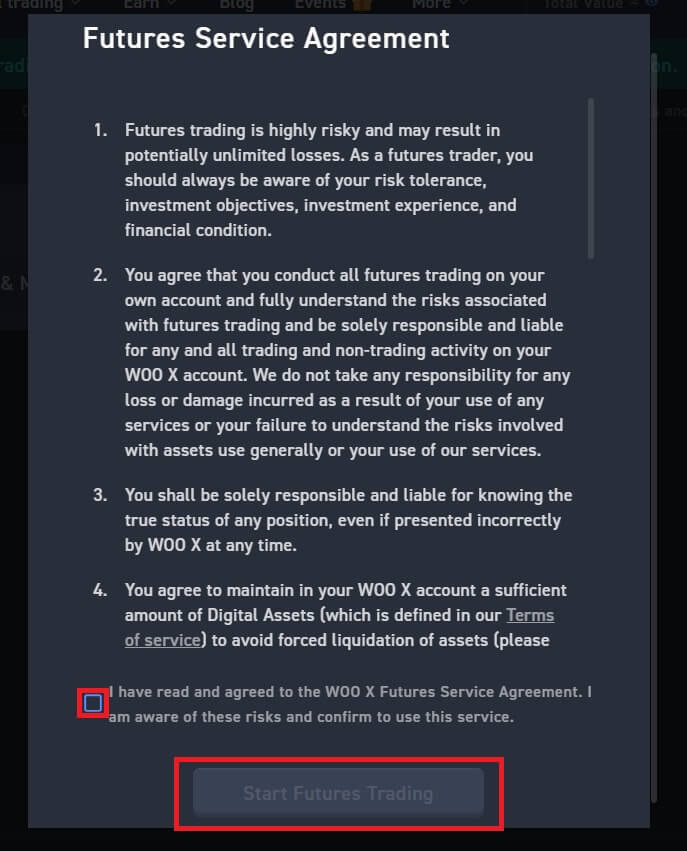

4. Read and Tick the box for Service Argeement and click [Start Futures Trading].

After that, you have successfully activated trading on WOO X Futures.

Explanation of Terminology on the Futures Trading Page on WOO X

For beginners, futures trading can be more complex than spot trading, as it involves a greater number of professional terms. To help new users understand and master futures trading effectively, this article aims to explain the meanings of these terms as they appear on the WOO X futures trading page.

We will introduce these terms in order of appearance, starting from left to right.

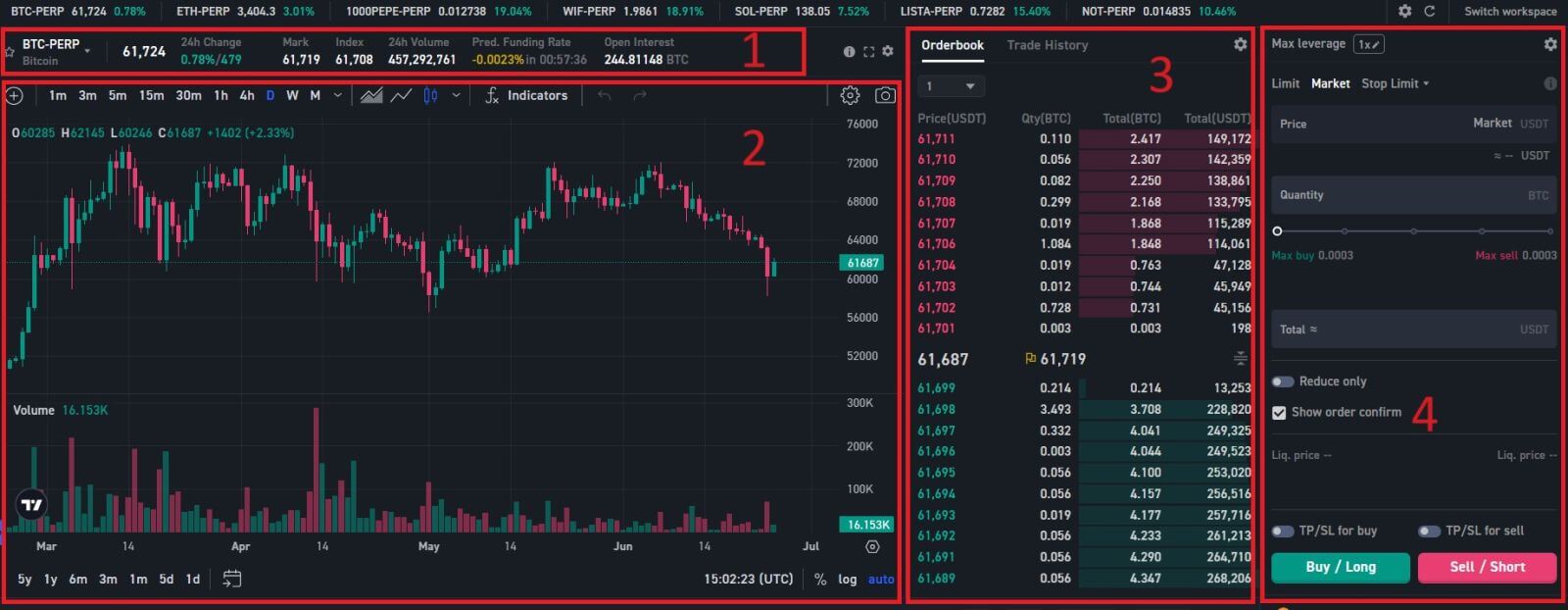

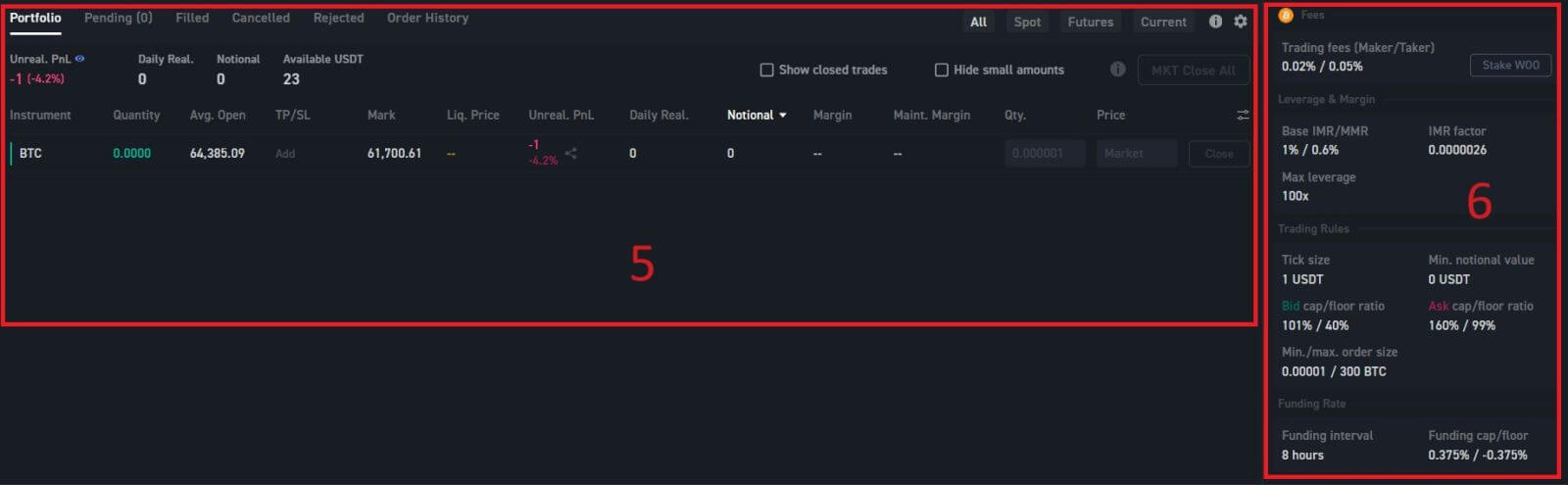

1. Top navigation menu: In this navigational section, you can have quick access to various functions, including: Futures Market, 24h Change, Mark, Index, 24h Volume, Pred. Funding Rate, Open Interest .

1. Top navigation menu: In this navigational section, you can have quick access to various functions, including: Futures Market, 24h Change, Mark, Index, 24h Volume, Pred. Funding Rate, Open Interest .

2. Chart Sector: The original chart is more suitable for beginners. The chart allows indicator customization and supports full-screen for a clearer indication of price movements.

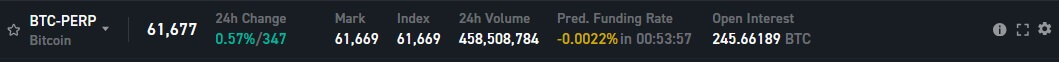

3. Order Book: A window to observe market trends during the trading process. In the order book area, you can observe each trade, the proportion of buyers and sellers, and more.

3. Order Book: A window to observe market trends during the trading process. In the order book area, you can observe each trade, the proportion of buyers and sellers, and more.

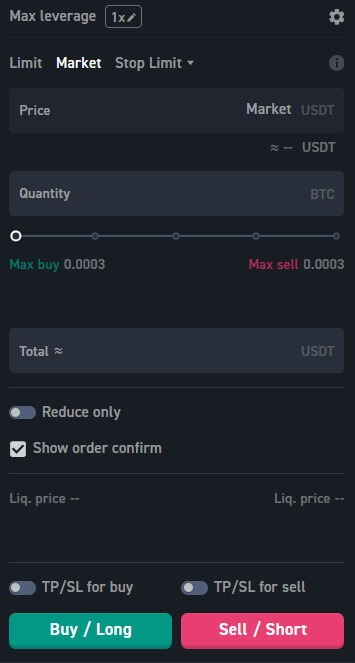

4. Order Sector: Here you can set various order parameters, including price, amount, trading unit, leverage, etc., after selecting the contract you want to trade. Once you are comfortable with your order parameter settings, click the "Buy/Long - Sell/Short" button to send your order to the market.

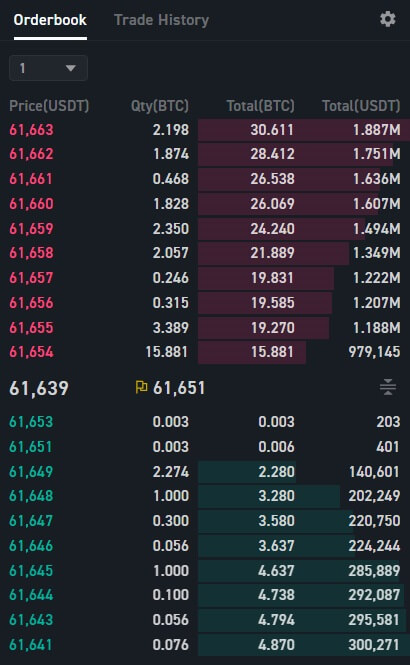

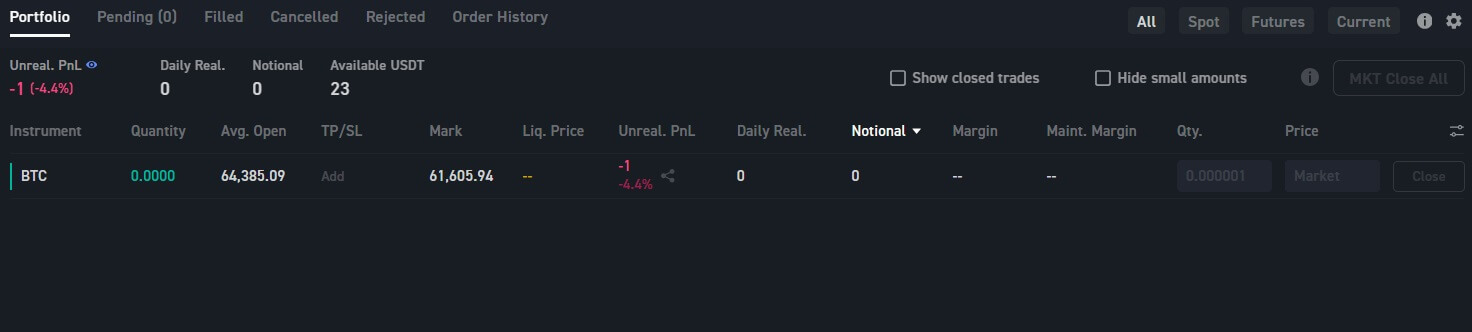

5. Portfolio Sector: After the orders are placed, you can check out the detailed transaction status under the various tabs of Pending order, Filled, Cancelled, etc.

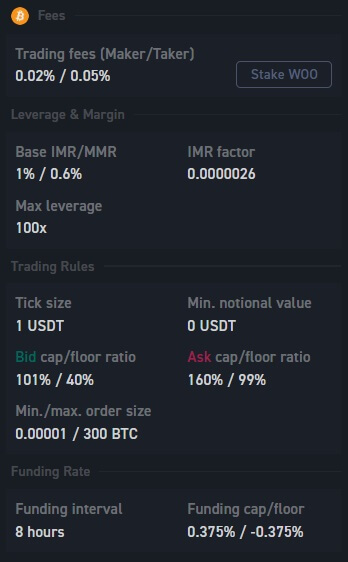

6. Fees Section: this including Trading fees, Leverage Margin, Trading Rules and Funding Rate.

How to Trade USDT Perpetual Futures on WOO X

Trade USDT Perpetual Futures on WOO X (Web)

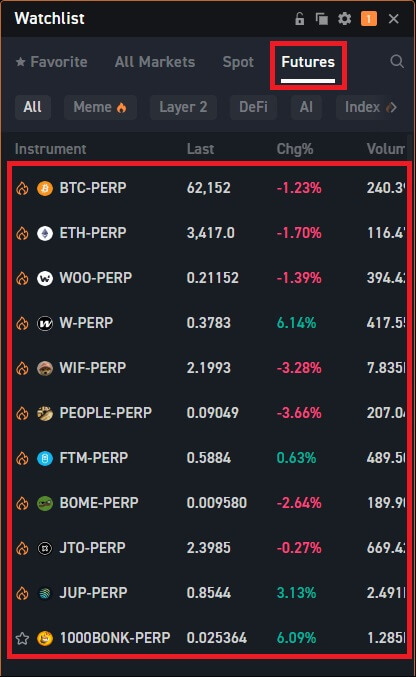

1. Open the WOO X website, click on [Trade], and select [Future]. 2. On the left-hand side, select BTC/PERP as an example from the list of futures.

2. On the left-hand side, select BTC/PERP as an example from the list of futures.

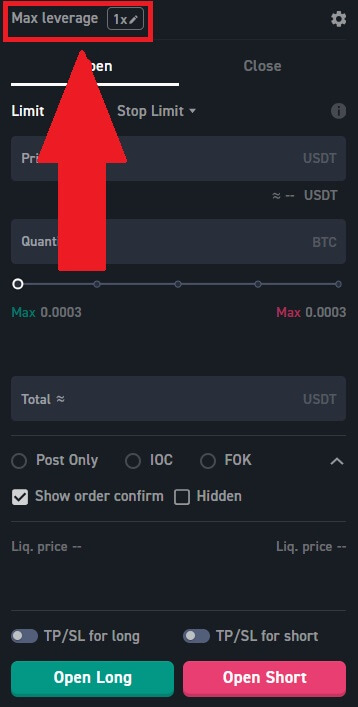

3. Click on the following part. Here, you can adjust the leverage multiplier by clicking on the number. After that, click [Confirm] to save your change.

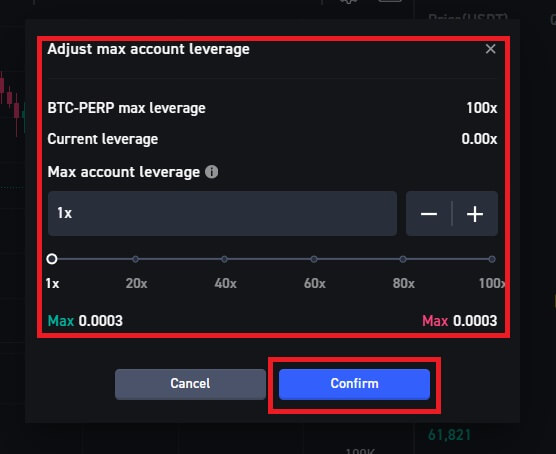

4. To open a position, users have three options: Limit Order, Market Order, and Trigger Order. Follow these steps:

Limit Order:

- Set your preferred buying or selling price.

- The order will only be executed when the market price reaches the specified level.

- If the market price doesn’t reach the set price, the limit order remains in the order book, awaiting execution.

- This option involves a transaction without specifying a buying or selling price.

- The system executes the transaction based on the latest market price when the order is placed.

- Users only need to input the desired order amount.

Stop-limit Order:

- Stop-limit orders are a combination of stop orders and limit orders. They are triggered when the market price reaches a certain level, but they are only executed at a specific price or better. This type of order is good for traders who want to have more control over the execution price of their orders.

Users can also utilize advanced features such as, "Stop Market", "OCO" and "Trailing Stop" to make orders.

Stop-Market:

- A stop market order is a conditional order type combining both stop and market orders. Stop market orders allow traders to set up an order that will be placed only when the price of an asset reaches a stop price. This price functions as a trigger that will activate the order.

- A trailing stop order is a type of stop order that follows the market price as it moves. This means that your stop price will be adjusted automatically to maintain a certain distance from the current market price.

- OCO Orders allow traders to completely set and forget about a trade. This combination of two instructions is built so that the execution of one, cancels the other. For example, when you place a limit sell order at $40,000, and a stop market order at $23,999 - the stop loss is canceled if the limit sell is filled, and oppositely if the stop market order is triggered.

Then, click [Buy/Long] to initiate a long position, or [Sell/Short] for a short position.

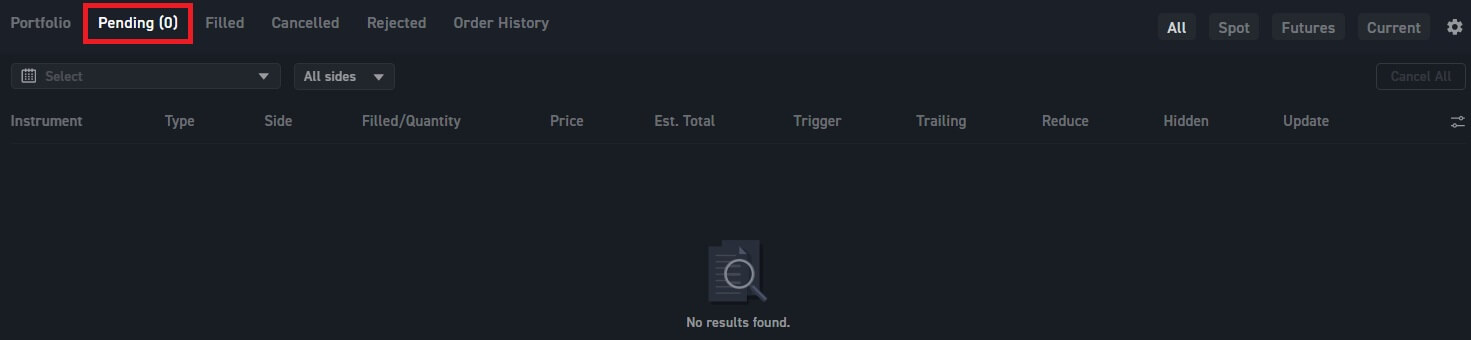

5. After placing your order, view it under [Pending] at the bottom of the page. You can cancel orders before they’re filled.

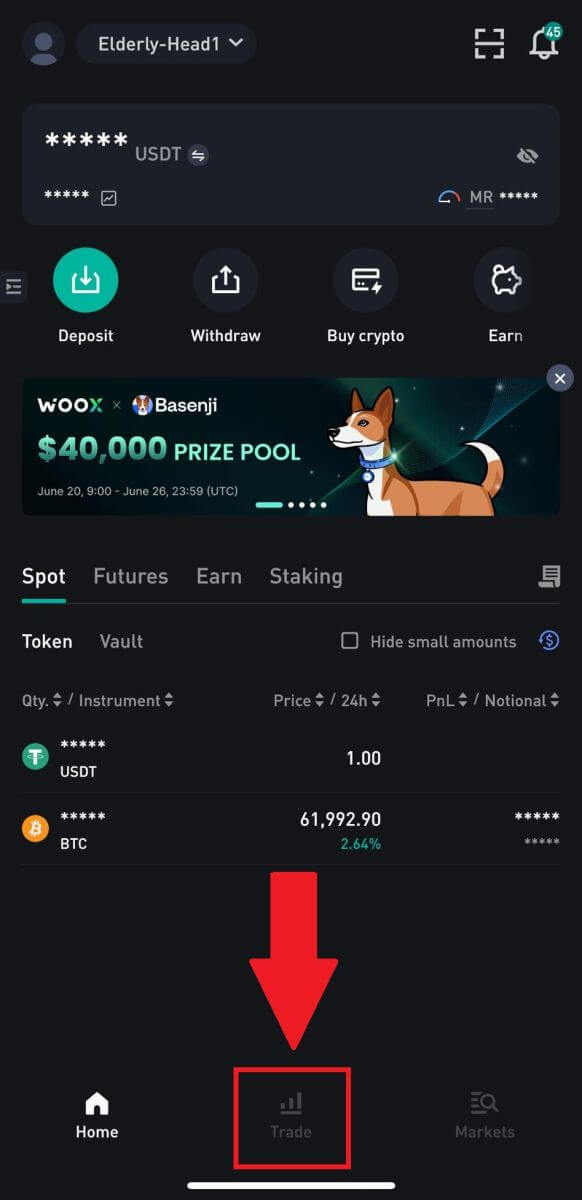

Trade USDT Perpetual Futures on WOO X (App)

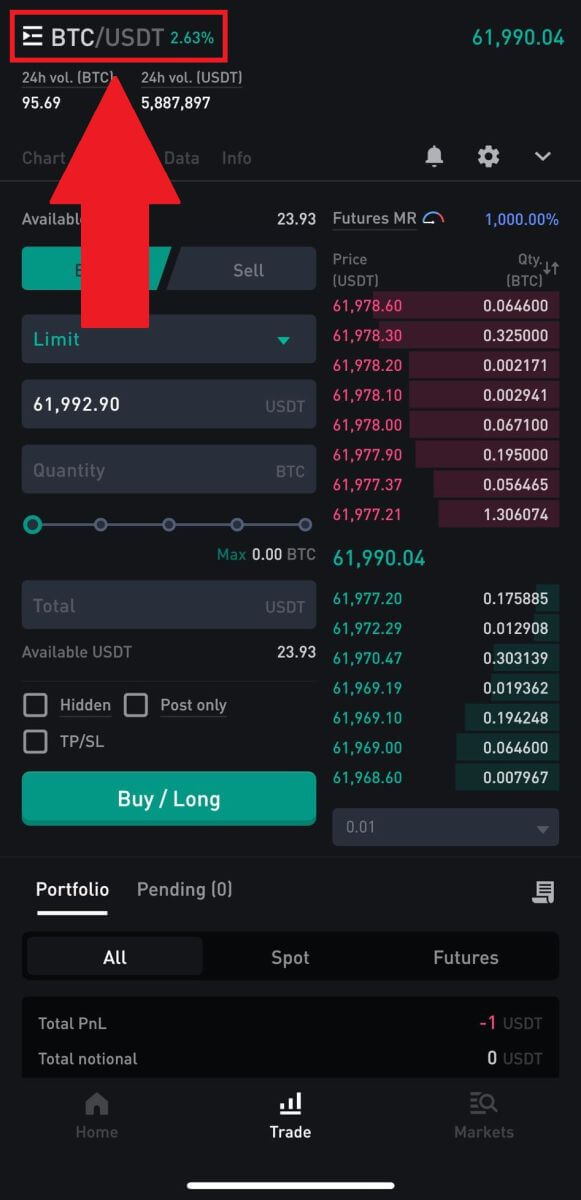

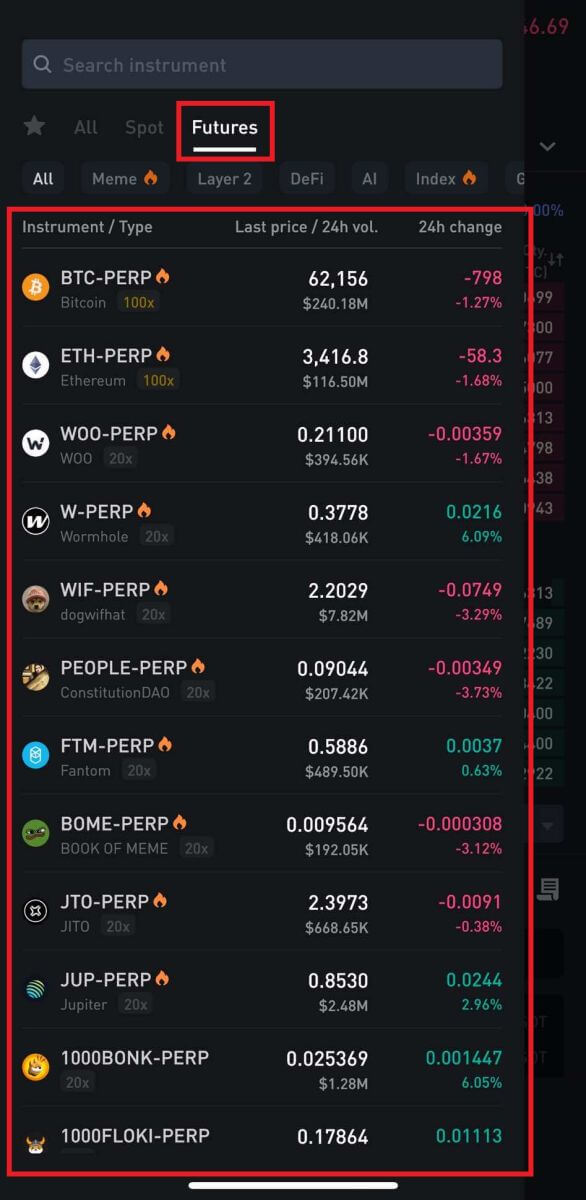

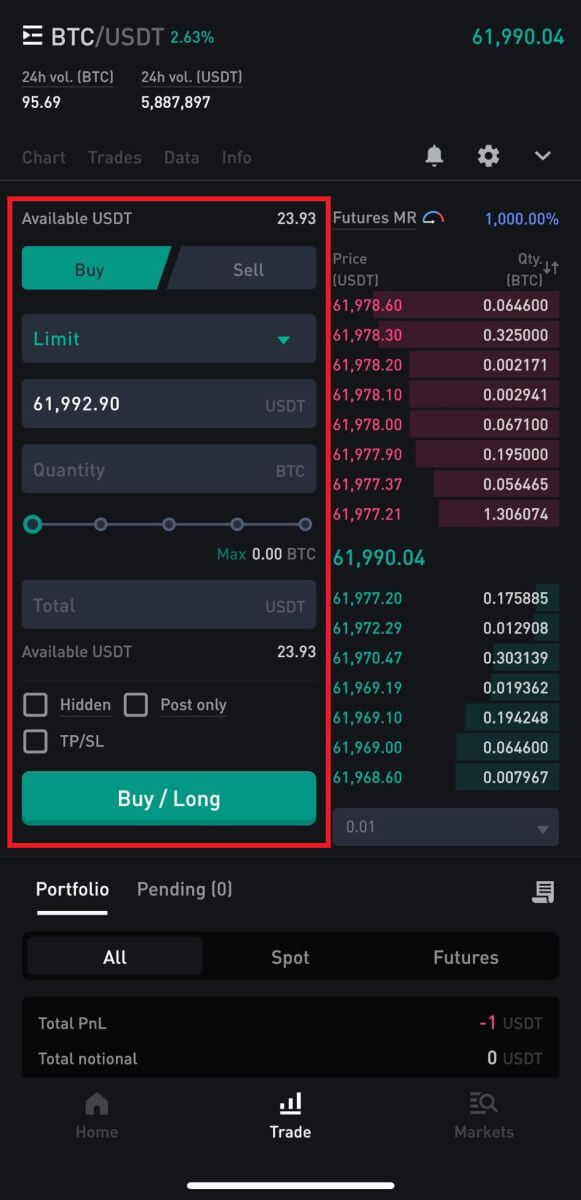

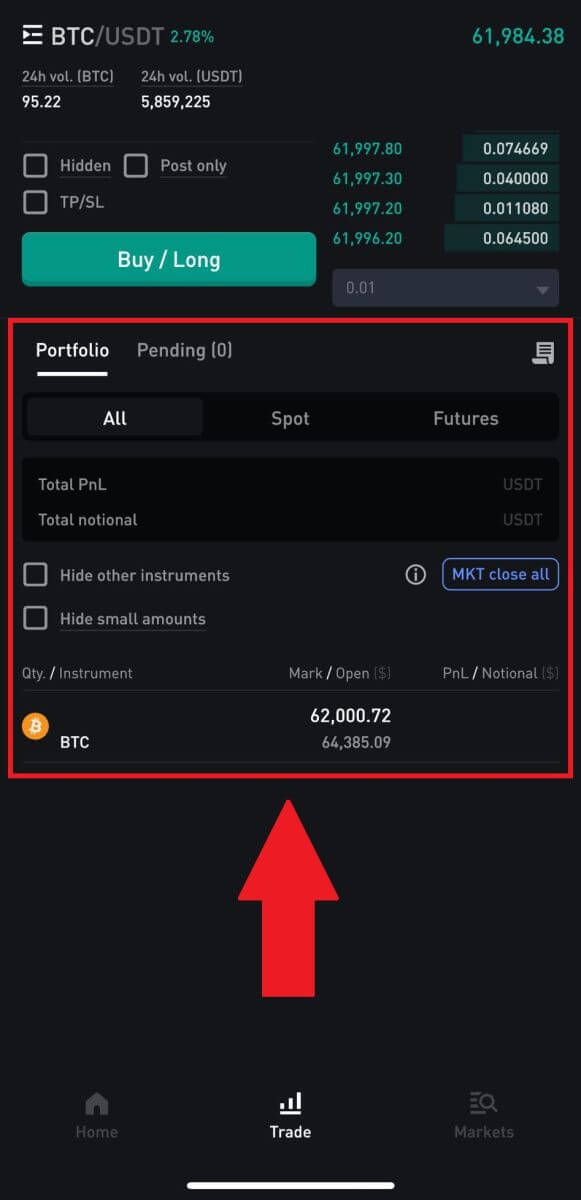

1. Open the WOO X app, click on [Trade]. 2. On the left-hand side, click BTC/USDT to open the market list. Select [BTC/PERP] as an example from the list of futures.

2. On the left-hand side, click BTC/USDT to open the market list. Select [BTC/PERP] as an example from the list of futures.

3. To open a position, users have three options: Limit Order, Market Order, and Trigger Order. Follow these steps:

Limit Order:

- Set your preferred buying or selling price.

- The order will only be executed when the market price reaches the specified level.

- If the market price doesn’t reach the set price, the limit order remains in the order book, awaiting execution.

- This option involves a transaction without specifying a buying or selling price.

- The system executes the transaction based on the latest market price when the order is placed.

- Users only need to input the desired order amount.

Stop-limit Order:

- Stop-limit orders are a combination of stop orders and limit orders. They are triggered when the market price reaches a certain level, but they are only executed at a specific price or better. This type of order is good for traders who want to have more control over the execution price of their orders.

Users can also utilize advanced features such as, "Stop Market", "OCO" and "Trailing Stop" to make orders.

Stop-Market:

- A stop market order is a conditional order type combining both stop and market orders. Stop market orders allow traders to set up an order that will be placed only when the price of an asset reaches a stop price. This price functions as a trigger that will activate the order.

- A trailing stop order is a type of stop order that follows the market price as it moves. This means that your stop price will be adjusted automatically to maintain a certain distance from the current market price.

- OCO Orders allow traders to completely set and forget about a trade. This combination of two instructions is built so that the execution of one, cancels the other. For example, when you place a limit sell order at $40,000, and a stop market order at $23,999 - the stop loss is canceled if the limit sell is filled, and oppositely if the stop market order is triggered.

Then, click [Buy/Long] to initiate a long position, or [Sell/Short] for a short position.

4. After placing your order, view it under [Pending] at the bottom of the page. You can cancel orders before they’re filled.

WOO X Future Trading Modes

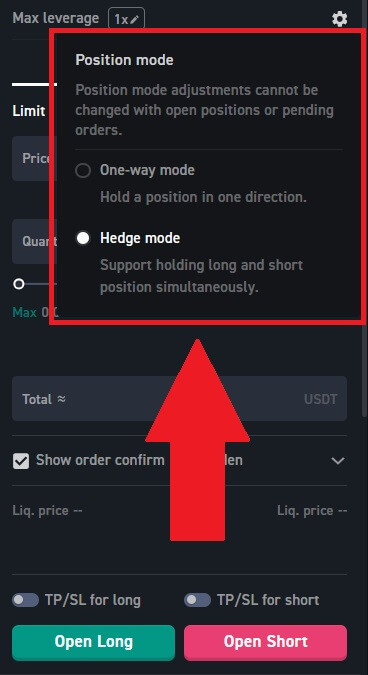

Position Mode

Position mode dictates how a position is maintained post-order execution, defining the conditions for opening or closing positions when placing orders. Typically, two modes are observed: one-way mode and hedge mode.

(1) One-way Mode:In one-way mode, you can only maintain either long or short positions of the same symbol, with profits and losses offsetting each other. Here, you can opt for a "Reduce-Only" order type, allowing solely the reduction of existing position holdings and preventing the initiation of positions in the opposite direction.

For instance, in trading USDT perpetual futures in one-way mode: Upon placing a sell order of 0.2 BTC and its full execution, a short position of 0.2 BTC is held. Subsequently buying 0.3 BTC:

- Without selecting "Reduce-Only" for the buy order, the system will close the short position of 0.2 BTC and open a long position of 0.1 BTC in the opposite direction. Thus, you’ll hold a single long position of 0.1 BTC.

- Conversely, selecting "Reduce-Only" for the buy order will solely close the short position of 0.2 BTC without initiating a position in the opposite direction.

(2) Hedge Mode:

Hedge mode enables the simultaneous holding of long and short positions of the same symbol, where profits and losses are not mutually offsetting. Here, you can hedge position risks in differing directions within the same symbol.

For example, in trading USDC perpetual futures using hedge mode: Upon selling 0.2 BTC and its complete fulfillment, a short position of 0.2 BTC is held. Subsequently placing an open order to buy 0.3 BTC results in holding a short position of 0.2 BTC and a long position of 0.3 BTC.

Notes:

- This setting applies universally to all symbols and remains unchangeable if open orders or positions exist.

- "Reduce-Only" is exclusively available in one-way mode. If no positions are held in one-way mode, this option cannot be utilized.

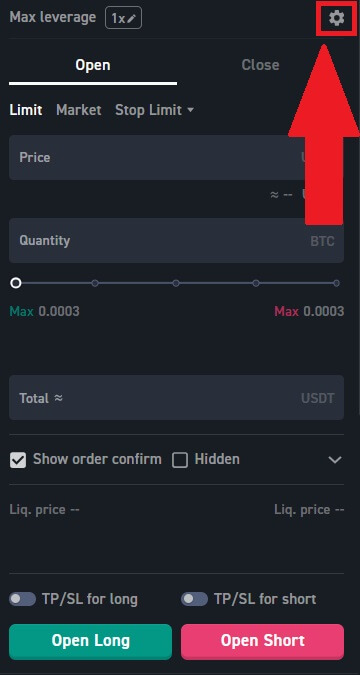

Steps to Switch Different Position Modes

1. Click the [Settings] icon on the future trading page, buying section.

2. Here, you can select [One-way Mode] or [Hedge Mode] as your Position mode.

Frequently Asked Questions (FAQ)

How Do Perpetual Futures Contracts Work?

Let’s take a hypothetical example to understand how perpetual futures work. Assume that a trader has some BTC. When they purchase the contract, they either want this sum to increase in line with the price of BTC/USDT or move in the opposite direction when they sell the contract. Considering that each contract is worth $1, if they purchase one contract at the price of $50.50, they must pay $1 in BTC. Instead, if they sell the contract, they get $1’s worth of BTC at the price they sold it for (it still applies if they sell before they acquire).

It is important to note that the trader is purchasing contracts, not BTC or dollars. So, why should you trade crypto perpetual futures? And how can it be certain that the contract’s price will follow the BTC/USDT price?

The answer is via a funding mechanism. Users with long positions are paid the funding rate (compensated by users with short positions) when the contract price is lower than the price of BTC, giving them an incentive to purchase contracts, causing the contract price to rise and realign with the price of BTC/USDT. Similarly, users with short positions can purchase contracts to close their positions, which will likely cause the price of the contract to increase to match the price of BTC.

In contrast to this situation, the opposite occurs when the price of the contract is higher than the price of BTC - i.e., users with long positions pay users with short positions, encouraging sellers to sell the contract, which drives its price closer to the price of BTC. The difference between the contract price and the price of BTC determines how much funding rate one will receive or pay.

What Are The Differences Between Perpetual Futures Contracts and Margin Trading?

Perpetual futures contracts and margin trading are both ways for traders to increase their exposure to the cryptocurrency markets, but there are some key differences between the two.

- Timeframe: Perpetual futures contracts do not have an expiration date, while margin trading is typically done over a shorter timeframe, with traders borrowing funds to open a position for a specific period of time.

- Settlement: Perpetual futures contracts settle based on the index price of the underlying cryptocurrency, while margin trading settles based on the price of the cryptocurrency at the time the position is closed.

- Leverage: Both perpetual futures contracts and margin trading allow traders to use leverage to increase their exposure to the markets. However, perpetual futures contracts typically offer higher levels of leverage than margin trading, which can increase both potential profits and potential losses.

- Fees: Perpetual futures contracts typically have a funding fee that is paid by traders who hold their positions open for an extended period of time. Margin trading, on the other hand, typically involves paying interest on the borrowed funds.

- Collateral: Perpetual futures contracts require traders to deposit a certain amount of cryptocurrency as collateral to open a position, while margin trading requires traders to deposit funds as collateral.

WOO X Futures Trading Rules

To prevent abnormal issues with Futures, WOO X has set up the order limits, price range, and price scope:

- Minimum order size: The minimum quantity you can place for certain trading pairs.

- Maximum order size: The maximum quantity you can place for a certain trading pair.

- Price range: The user can only place the order within the following price range.

- Futures: The price range is between market price*0.03 for both sides in the order book.

- Price Scope:

- Buy: Your order price can not be lower than (1-scope)*Mark Price

- Sell: Your order price can not be higher than (1+scope)* Mark Price

Note: If your order price is over the Price range or Price scope, you will not be able to place the orders. Please adjust your order price accordingly.

Futures order limits

| Instrument | Min Order size |

Max Order size |

Price Range | Price Scope |

| 1000BONK-PERP | 1 | 6,000,000 | 0.03 | 0.6 |

| 1000FLOKI-PERP | 1 | 6,000,000 | 0.03 | 0.6 |

| 1000LUNC-PERP | 1 | 6,000,000 | 0.03 | 0.6 |

| 1000PEPE-PERP | 1 | 6,000,000 | 0.03 | 0.6 |

| 1000SATS-PERP | 1 | 6,000,000 | 0.03 | 0.6 |

| 1000SHIB-PERP | 1 | 6,000,000 | 0.03 | 0.6 |

| 1INCH-PERP | 1 | 6,000,000 | 0.03 | 0.6 |

| AAVE-PERP | 0.01 | 19,416 | 0.03 | 0.6 |

| ACE-PERP | 0.01 | 40,000 | 0.03 | 0.6 |

| ACH-PERP | 1 | 5,000,000 | 0.05 | 0.6 |

| ADA-PERP | 1 | 15,042,536 | 0.03 | 0.6 |

| AEVO-PERP | 0.1 | 100,000 | 0.05 | 0.6 |

| AI-PERP | 0.1 | 500,000 | 0.03 | 0.6 |

| ALGO-PERP | 1 | 4,872,841 | 0.03 | 0.6 |

| ALT-PERP | 1 | 1,000,000 | 0.03 | 0.6 |

| ANKR-PERP | 1 | 15,000,000 | 0.03 | 0.6 |

| APE-PERP | 1 | 683,480 | 0.03 | 0.6 |

| APT-PERP | 0.01 | 300,524 | 0.03 | 0.6 |

| ARB-PERP | 0.1 | 1,000,000 | 0.03 | 0.6 |

| ARKM-PERP | 1 | 200,000 | 0.05 | 0.6 |

| AR-PERP | 0.01 | 44,160 | 0.03 | 0.6 |

| ASTR-PERP | 1 | 5,000,000 | 0.03 | 0.6 |

| ATH-PERP | 1 | 1,500,000 | 0.05 | 0.6 |

| ATOM-PERP | 0.1 | 226,730 | 0.03 | 0.6 |

| AUCTION-PERP | 0.01 | 10,000 | 0.03 | 0.6 |

| AVAX-PERP | 0.01 | 199,267 | 0.03 | 0.6 |

| AXL-PERP | 0.1 | 100,000 | 0.03 | 0.6 |

| AXS-PERP | 0.1 | 250,000 | 0.03 | 0.6 |

| BAKE-PERP | 1 | 2,000,000 | 0.03 | 0.6 |

| BAND-PERP | 0.1 | 281,671 | 0.03 | 0.6 |

| BB-PERP | 1 | 30,000 | 0.03 | 0.6 |

| BCH-PERP | 0.001 | 23,670 | 0.03 | 0.6 |

| BEAM-PERP | 1 | 5,000,000 | 0.03 | 0.6 |

| BICO-PERP | 1 | 200,000 | 0.03 | 0.6 |

| BIGTIME-PERP | 1 | 2,000,000 | 0.03 | 0.6 |

| BLUR-PERP | 1 | 500,000 | 0.03 | 0.6 |

| BLZ-PERP | 1 | 5,000,000 | 0.05 | 0.6 |

| BNB-PERP | 0.001 | 30,156 | 0.03 | 0.6 |

| BOME-PERP | 1 | 5,000,000 | 0.03 | 0.6 |

| BSV-PERP | 0.01 | 10,000 | 0.03 | 0.6 |

| BTC-PERP | 0.00001 | 300 | 0.01 | 0.6 |

| C98-PERP | 1 | 6,000,000 | 0.03 | 0.6 |

| CAKE-PERP | 0.1 | 100,000 | 0.03 | 0.6 |

| CFX-PERP | 1 | 5,000,000 | 0.03 | 0.6 |

| CHZ-PERP | 1 | 11,810,110 | 0.03 | 0.6 |

| CKB-PERP | 1 | 3,000,000 | 0.03 | 0.6 |

| COMP-PERP | 0.01 | 13,031 | 0.03 | 0.6 |

| CRO-PERP | 1 | 1,000,000 | 0.03 | 0.6 |

| CRV-PERP | 1 | 2,296,036 | 0.03 | 0.6 |

| CYBER-PERP | 0.01 | 20,000 | 0.05 | 0.6 |

| DOGE-PERP | 1 | 73,870,409 | 0.03 | 0.6 |

| DOT-PERP | 0.1 | 677,855 | 0.03 | 0.6 |

| DRIFT-PERP | 1 | 150,000 | 0.05 | 0.6 |

| DYDX-PERP | 0.01 | 895,742 | 0.03 | 0.6 |

| DYM-PERP | 0.1 | 80,000 | 0.03 | 0.6 |

| EGLD-PERP | 0.01 | 19,080 | 0.03 | 0.6 |

| ENA-PERP | 1 | 100,000 | 0.03 | 0.6 |

| ENS-PERP | 0.01 | 90,682 | 0.03 | 0.6 |

| EOS-PERP | 1 | 4,089,361 | 0.03 | 0.6 |

| ETC-PERP | 0.01 | 234,526 | 0.03 | 0.6 |

| ETHFI-PERP | 0.1 | 100,000 | 0.03 | 0.6 |

| ETHW-PERP | 0.01 | 121,768 | 0.03 | 0.6 |

| ETH-PERP | 0.0001 | 4,000 | 0.01 | 0.6 |

| FET-PERP | 0.1 | 1,000,000 | 0.03 | 0.6 |

| FIL-PERP | 0.1 | 574,852 | 0.03 | 0.6 |

| FLOW-PERP | 0.1 | 500,000 | 0.03 | 0.6 |

| FTM-PERP | 1 | 9,887,912 | 0.03 | 0.6 |

| FTT-PERP | 0.1 | 100,000 | 0.03 | 0.6 |

| FXS-PERP | 0.1 | 30,000 | 0.03 | 0.6 |

| GALA-PERP | 1 | 26,423,397 | 0.03 | 0.6 |

| GAS-PERP | 0.1 | 100,000 | 0.03 | 0.6 |

| GLM-PERP | 1 | 400,000 | 0.03 | 0.6 |

| GM30-PERP | 1 | 6,000,000 | 0.03 | 0.6 |

| GMT-PERP | 1 | 6,180,855 | 0.03 | 0.6 |

| GMX-PERP | 0.01 | 5,000 | 0.03 | 0.6 |

| GRT-PERP | 1 | 9,475,764 | 0.03 | 0.6 |

| HBAR-PERP | 1 | 5,000,000 | 0.03 | 0.6 |

| HIFI-PERP | 1 | 600,000 | 0.05 | 0.6 |

| ICP-PERP | 0.01 | 100,000 | 0.03 | 0.6 |

| ID-PERP | 1 | 1,000,000 | 0.03 | 0.6 |

| ILV-PERP | 0.01 | 1,000 | 0.03 | 0.6 |

| IMX-PERP | 0.1 | 400,000 | 0.03 | 0.6 |

| INJ-PERP | 0.01 | 200,000 | 0.03 | 0.6 |

| IOTX-PERP | 1 | 10,000,000 | 0.03 | 0.6 |

| IO-PERP | 1 | 25,000 | 0.03 | 0.6 |

| JOE-PERP | 1 | 1,000,000 | 0.03 | 0.6 |

| JTO-PERP | 0.1 | 50,000 | 0.03 | 0.6 |

| JUP-PERP | 1 | 1,000,000 | 0.03 | 0.6 |

| KAS-PERP | 1 | 5,000,000 | 0.03 | 0.6 |

| KLAY-PERP | 10 | 2,000,000 | 0.03 | 0.6 |

| KSM-PERP | 0.01 | 17,670 | 0.03 | 0.6 |

| L2-PERP | 1 | 6,000,000 | 0.03 | 0.6 |

| LDO-PERP | 0.1 | 255,677 | 0.03 | 0.6 |

| LINA-PERP | 1 | 83,875,475 | 0.03 | 0.6 |

| LINK-PERP | 0.01 | 683,859 | 0.03 | 0.6 |

| LISTA-PERP | 1 | 120,000 | 0.05 | 0.6 |

| LOOKS-PERP | 0.1 | 718,456 | 0.03 | 0.6 |

| LOOM-PERP | 1 | 3,000,000 | 0.05 | 0.6 |

| LPT-PERP | 0.01 | 30,000 | 0.03 | 0.6 |

| LQTY-PERP | 0.1 | 150,000 | 0.05 | 0.6 |

| LRC-PERP | 1 | 1,000,000 | 0.03 | 0.6 |

| LTC-PERP | 0.01 | 75,854 | 0.03 | 0.6 |

| MAGIC-PERP | 0.1 | 500,000 | 0.03 | 0.6 |

| MANA-PERP | 1 | 2,947,775 | 0.03 | 0.6 |

| MANTA-PERP | 0.1 | 500,000 | 0.03 | 0.6 |

| MASK-PERP | 0.1 | 585,864 | 0.03 | 0.6 |

| MATIC-PERP | 1 | 5,790,679 | 0.03 | 0.6 |

| MEMES-PERP | 0.1 | 10,000 | 0.05 | 0.6 |

| MEME-PERP | 1 | 20,000,000 | 0.03 | 0.6 |

| MERL-PERP | 0.1 | 100,000 | 0.03 | 0.6 |

| METIS-PERP | 0.001 | 1,000 | 0.03 | 0.6 |

| MEW-PERP | 1 | 20,000,000 | 0.03 | 0.6 |

| MINA-PERP | 1 | 500,000 | 0.03 | 0.6 |

| MKR-PERP | 0.0001 | 500 | 0.03 | 0.6 |

| MYRO-PERP | 1 | 100,000 | 0.05 | 0.6 |

| NEAR-PERP | 0.1 | 1,072,994 | 0.03 | 0.6 |

| NEO-PERP | 0.01 | 88,335 | 0.03 | 0.6 |

| NFP-PERP | 1 | 500,000 | 0.03 | 0.6 |

| NMR-PERP | 0.01 | 25,000 | 0.05 | 0.6 |

| NOT-PERP | 1 | 10,000,000 | 0.03 | 0.6 |

| NYAN-PERP | 1 | 150,000 | 0.05 | 0.6 |

| OMNI-PERP | 0.01 | 2,000 | 0.03 | 0.6 |

| ONDO-PERP | 1 | 1,000,000 | 0.03 | 0.6 |

| ONE-PERP | 1 | 26,696,292 | 0.03 | 0.6 |

| OP-PERP | 0.1 | 1,152,413 | 0.03 | 0.6 |

| ORDI-PERP | 0.01 | 1,000,000 | 0.03 | 0.6 |

| PENDLE-PERP | 0.1 | 500,000 | 0.03 | 0.6 |

| PEOPLE-PERP | 1 | 5,000,000 | 0.03 | 0.6 |

| PERP-PERP | 0.1 | 1,000,000 | 0.03 | 0.6 |

| PIXEL-PERP | 1 | 500,000 | 0.03 | 0.6 |

| POLYX-PERP | 1 | 2,000,000 | 0.03 | 0.6 |

| POPCAT-PERP | 1 | 60,000 | 0.03 | 0.6 |

| PORTAL-PERP | 0.1 | 250,000 | 0.03 | 0.6 |

| POWR-PERP | 1 | 750,000 | 0.05 | 0.6 |

| PRCL-PERP | 1 | 200,000 | 0.03 | 0.6 |

| PYTH-PERP | 1 | 800,000 | 0.03 | 0.6 |

| RDNT-PERP | 1 | 1,500,000 | 0.03 | 0.6 |

| REZ-PERP | 1 | 200,000 | 0.05 | 0.6 |

| RIF-PERP | 1 | 2,000,000 | 0.05 | 0.6 |

| RNDR-PERP | 0.1 | 500,000 | 0.03 | 0.6 |

| RON-PERP | 0.1 | 100,000 | 0.03 | 0.6 |

| ROSE-PERP | 1 | 500,000 | 0.03 | 0.6 |

| RUNE-PERP | 0.1 | 1,000,000 | 0.03 | 0.6 |

| SAGA-PERP | 0.1 | 20,000 | 0.03 | 0.6 |

| SAND-PERP | 1 | 3,358,992 | 0.03 | 0.6 |

| SEI-PERP | 0.1 | 200,000 | 0.03 | 0.6 |

| SKL-PERP | 1 | 15,569,405 | 0.03 | 0.6 |

| SLERF-PERP | 1 | 200,000 | 0.05 | 0.6 |

| SLN-PERP | 0.1 | 20,000 | 0.05 | 0.6 |

| SNX-PERP | 0.1 | 282,241 | 0.03 | 0.6 |

| SOL-PERP | 0.001 | 228,321 | 0.03 | 0.6 |

| SSV-PERP | 0.01 | 25,000 | 0.03 | 0.6 |

| STG-PERP | 1 | 500,000 | 0.03 | 0.6 |

| STORJ-PERP | 1 | 1,363,351 | 0.03 | 0.6 |

| STRK-PERP | 0.1 | 300,000 | 0.03 | 0.6 |

| STX-PERP | 0.1 | 1,000,000 | 0.03 | 0.6 |

| SUI-PERP | 0.1 | 2,500,000 | 0.03 | 0.6 |

| SUSHI-PERP | 1 | 1,038,579 | 0.03 | 0.6 |

| TAIKO-PERP | 0.1 | 12,000 | 0 | 0 |

| TAO-PERP | 0.001 | 1,000 | 0.03 | 0.6 |

| THETA-PERP | 0.1 | 1,648,081 | 0.03 | 0.6 |

| TIA-PERP | 0.1 | 200,000 | 0.03 | 0.6 |

| TNSR-PERP | 0.1 | 200,000 | 0.03 | 0.6 |

| TOKEN-PERP | 1 | 10,000,000 | 0.05 | 0.6 |

| TON-PERP | 0.1 | 100,000 | 0.03 | 0.6 |

| TRB-PERP | 0.001 | 50,000 | 0.05 | 0.6 |

| TRX-PERP | 1 | 50,033,379 | 0.03 | 0.6 |

| TURBO-PERP | 1 | 15,000,000 | 0.03 | 0.6 |

| UNI-PERP | 0.1 | 248,162 | 0.03 | 0.6 |

| USDC-PERP | 0.1 | 100,000 | 0.03 | 0.6 |

| USTC-PERP | 1 | 20,000,000 | 0.03 | 0.6 |

| VET-PERP | 1 | 47,982,153 | 0.03 | 0.6 |

| WIF-PERP | 0.1 | 1,000,000 | 0.03 | 0.6 |

| WLD-PERP | 0.1 | 200,000 | 0.03 | 0.6 |

| WOO-PERP | 1 | 2,513,232 | 0.03 | 0.6 |

| W-PERP | 0.1 | 100,000 | 0.03 | 0.6 |

| XAI-PERP | 0.1 | 500,000 | 0.03 | 0.6 |

| XLM-PERP | 1 | 27,164,567 | 0.03 | 0.6 |

| XRP-PERP | 1 | 18,661,785 | 0.03 | 0.6 |

| XTZ-PERP | 0.1 | 1,000,000 | 0.03 | 0.6 |

| YFI-PERP | 0.0001 | 127 | 0.03 | 0.6 |

| YGG-PERP | 1 | 1,000,000 | 0.03 | 0.6 |

| ZETA-PERP | 0.1 | 500,000 | 0.03 | 0.6 |

| ZIL-PERP | 1 | 10,000,000 | 0.03 | 0.6 |

| ZK-PERP | 1 | 350,000 | 0.03 | 0.6 |

| ZRO-PERP | 0.1 | 25,000 | 0.03 | 0.6 |

| ZRX-PERP | 0.1 | 1,000,000 | 0.03 | 0.6 |

| ZRX-PERP | 0.1 | 1,000,000 | 0.03 | 0.6 |

Let’s use these limits as an example:

The market price of BTC-PERP is 40,000 USDT

BTC-PERP price range is 0.03, and the price scope is 0.1

Buy- Price Range: You can not buy BTC-PERP higher than the order limit price of 40,000+(40,000*0.03)=41,200

- Price Scope: You can not buy BTC-PERP lower than the order limit price (1-0.1)*40,000=36,000

- Price Range: You can not sell BTC-PERP lower than the order limit price of 40,000 - (40,000*0.03)=38,800 USDT

- Price Scope: You can not sell BTC-PERP higher than the order limit price (1+0.1)*40,000=44,000 USDT