How to Trade Crypto and Withdraw from WOO X

How to Trade Cryptocurrency on WOO X

How to Trade Spot on WOO X (Web)

A spot trade is a simple transaction between a buyer and a seller to trade at the current market rate, known as the spot price. The trade takes place immediately when the order is fulfilled.Users can prepare spot trades in advance to trigger when a specific (better) spot price is reached, known as a limit order. You can make spot trades on WOO X through our trading page interface.

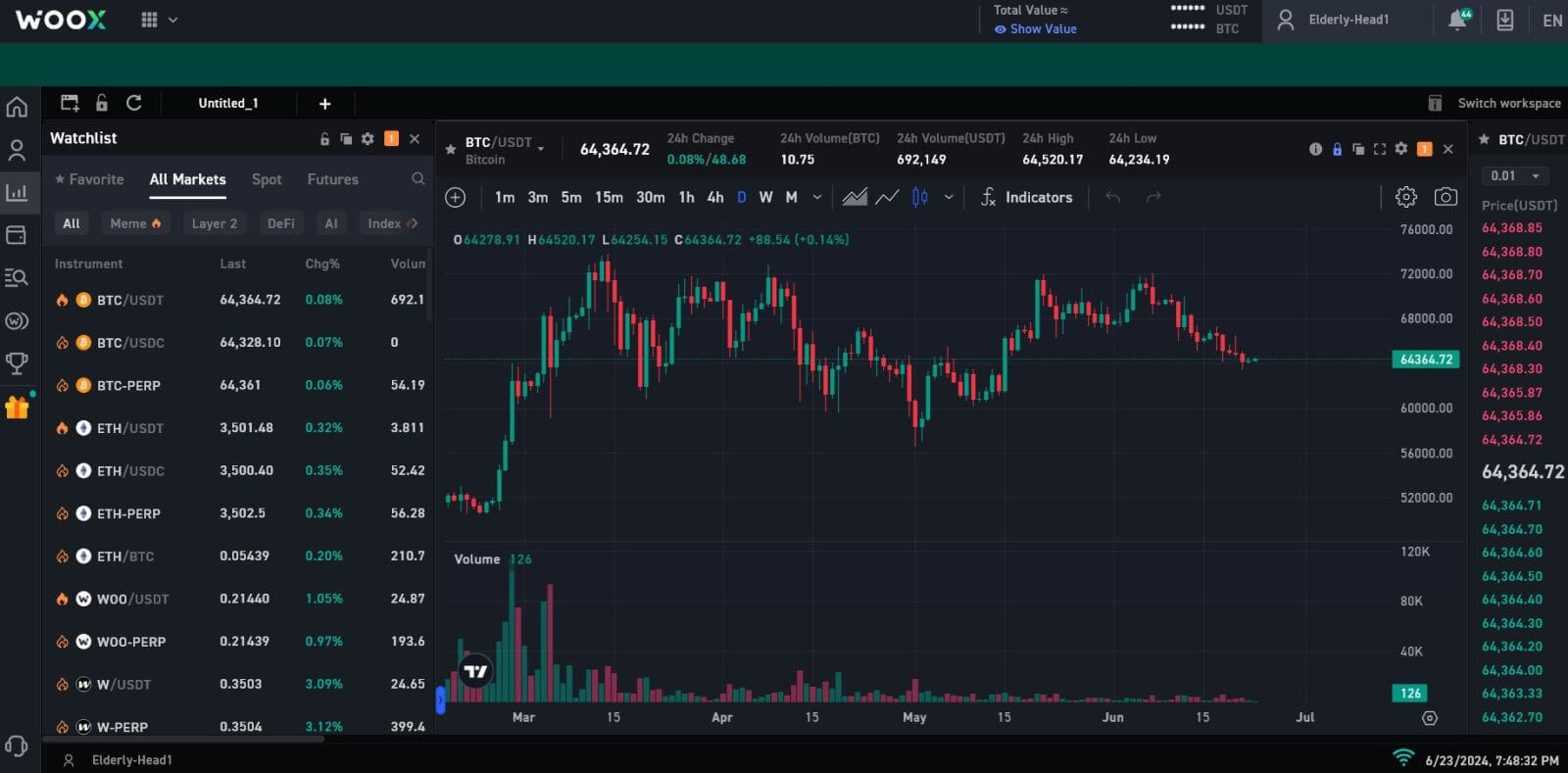

1. Visit our WOO X website, and log in to your account. Your first page after you log in is the trading page.

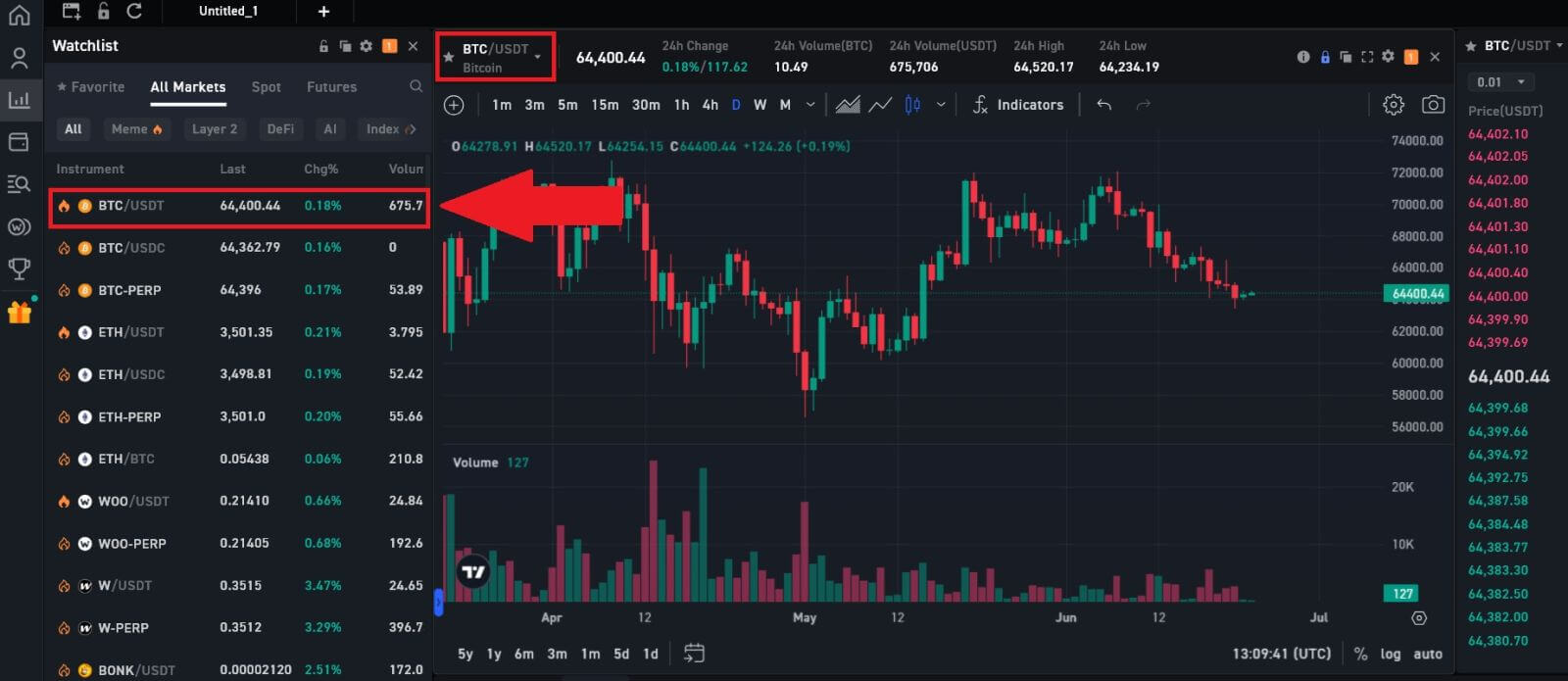

2. You will now find yourself on the trading page interface.

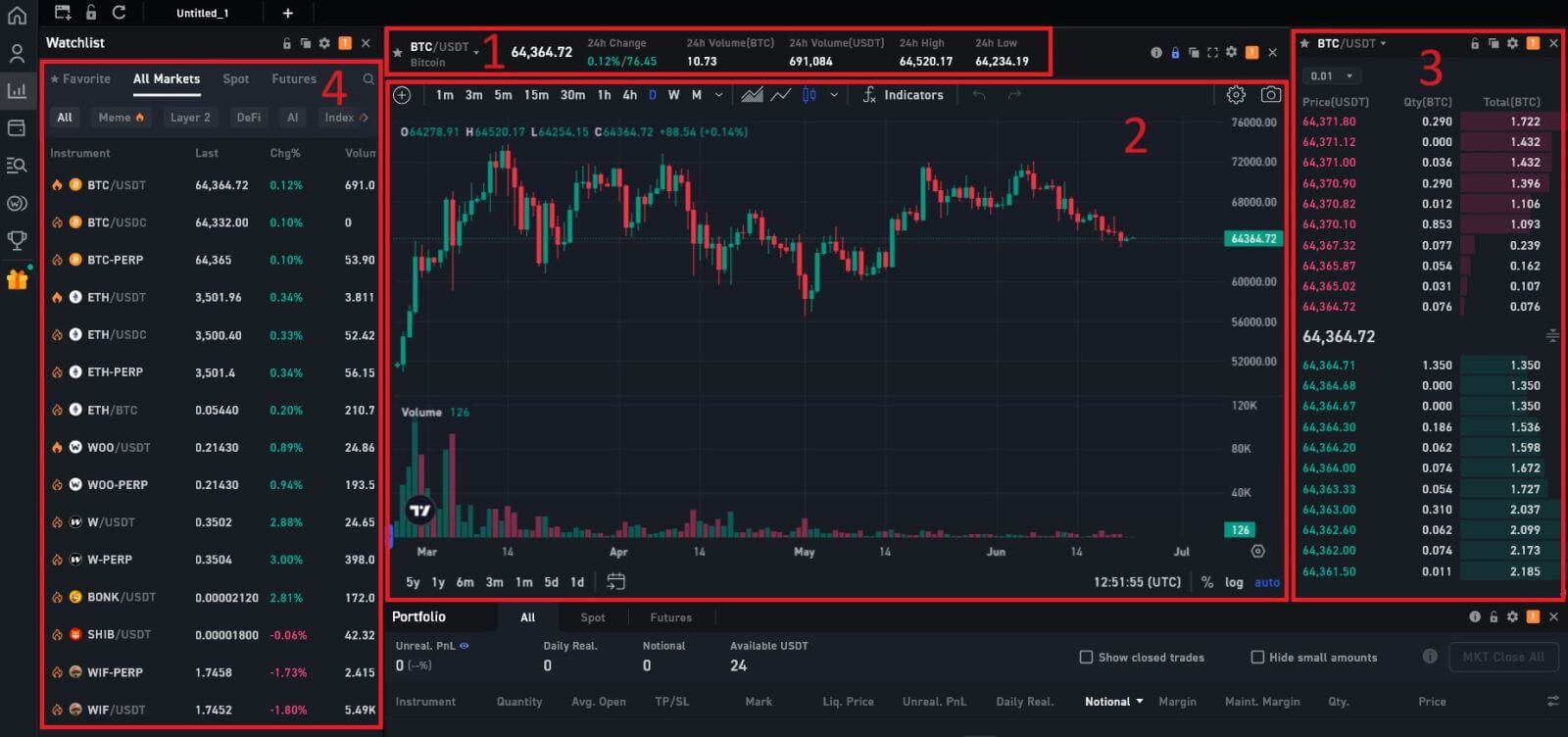

1. Market Price Trading volume of trading pair in 24 hours:

1. Market Price Trading volume of trading pair in 24 hours:This refers to the total volume of trading activity that has occurred within the last 24 hours for specific spot pairs (e.g., BTC/USD, ETH/BTC).

2. Candlestick chart and Technical Indicators:

Candlestick charts are graphical representations of price movements over a specific time period. They display opening, closing, and high, and low prices within the chosen timeframe, helping traders analyze price trends and patterns.

3. Asks (Sell orders) book / Bids (Buy orders) book:

The order book displays a list of all open buy and sell orders for a particular cryptocurrency pair. It shows the current market depth and helps traders gauge supply and demand levels.

4. Market Watch List:

Here, you can view and choose the trading crypto that you want.

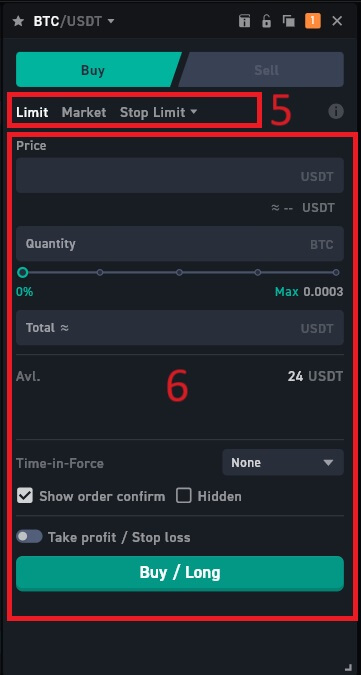

5. Type of order:

WOO X has 6 Order Types:

- Limit Order: Set your own buying or selling price. The trade will only be executed when the market price reaches the set price. If the market price does not reach the set price, the limit order will continue to wait for execution.

- Market Order: This order type will automatically execute the trade at the current best price available in the market.

- Stop-Limit: Stop-limit orders are a combination of stop orders and limit orders. They are triggered when the market price reaches a certain level, but they are only executed at a specific price or better. This type of order is good for traders who want to have more control over the execution price of their orders.

- Stop-Market: A stop market order is a conditional order type combining both stop and market orders. Stop market orders allow traders to set up an order that will be placed only when the price of an asset reaches a stop price. This price functions as a trigger that will activate the order.

- Trailing Stop: A trailing stop order is a type of stop order that follows the market price as it moves. This means that your stop price will be adjusted automatically to maintain a certain distance from the current market price.

- OCO: OCO Orders allow traders to completely set and forget about a trade. This combination of two instructions is built so that the execution of one, cancels the other. For example, when you place a limit sell order at $40,000, and a stop market order at $23,999 - the stop loss is canceled if the limit sell is filled, and oppositely if the stop market order is triggered.

6. Buy / Sell cryptocurrency:

This is where traders can place orders to buy or sell cryptocurrencies. It typically includes options for market orders (executed immediately at the current market price) and limit orders (executed at a specified price).

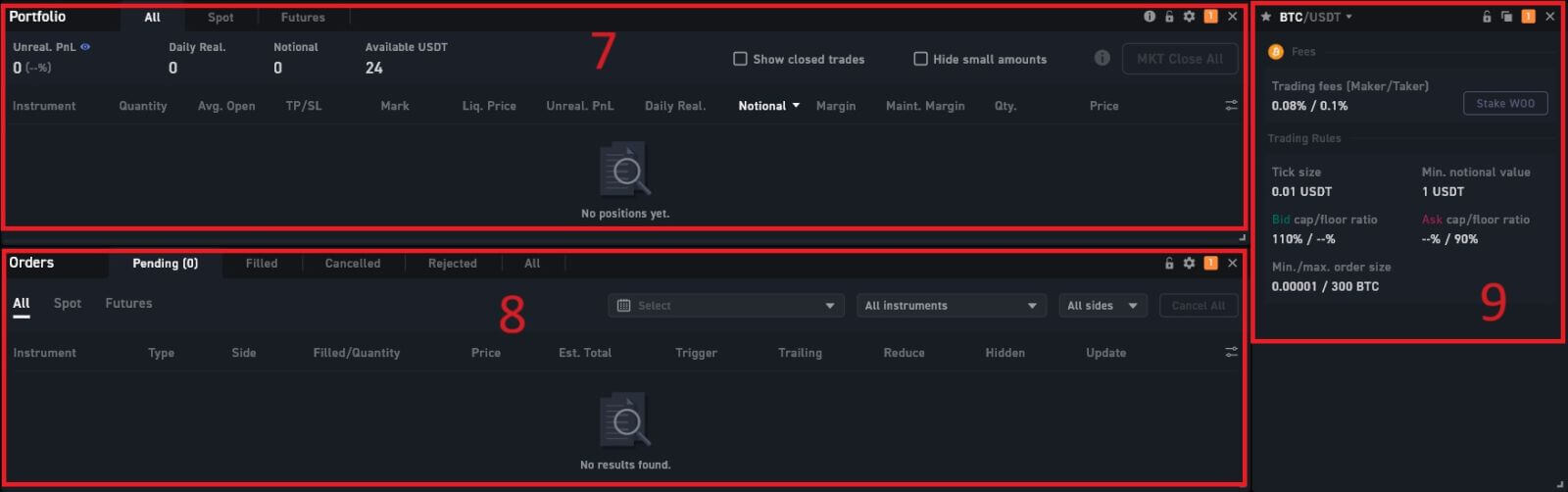

7. Portfolio Section:

This section including your token, balance, mark, ... of your order.

8. Order History:

These sections allow traders to manage their orders.

9. Trading Fees and Trading Rules Section:

Here you can manage your Trading Rules and Trading Fees.

For example, we will make a [Limit order] trade to buy BTC

1. Log in to your WOO X account. Choose BTC/USDT from the market watchlist.

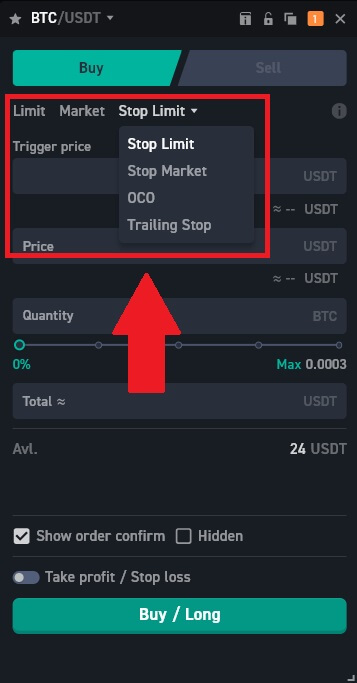

2. Go to the Buy/Sell Section. Select the type of order (we will use Limit Order as an example) in the "Limit Order" dropdown menu.

2. Go to the Buy/Sell Section. Select the type of order (we will use Limit Order as an example) in the "Limit Order" dropdown menu.

- Limit Order allows you to place an order to buy or sell crypto for a specific price;

- Market Order allows you to buy or sell crypto for the current real-time market price;

- Users can also utilize advanced features such as "Stop Limit", "Stop Market", "OCO" and "Trailing Stop" to make orders. Input the BTC amount you want to buy, and the expenses of USDT will be displayed accordingly.

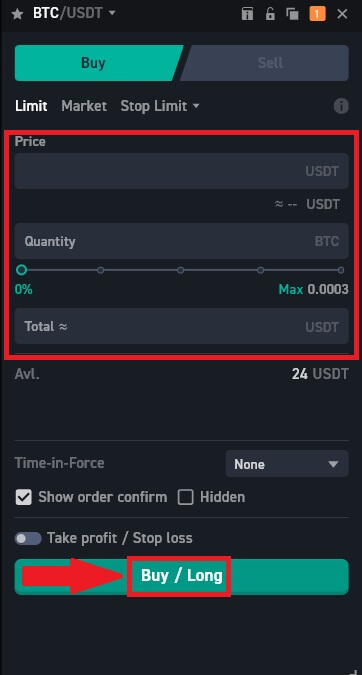

3. Enter the price in USDT that you want to buy BTC at and the amount of BTC you want to buy. Then click [Buy/Long] to continue the process.

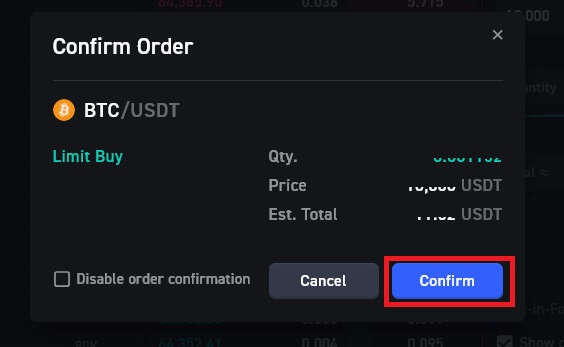

4. Review your order, then click [Confirm] and wait for the trade to be processed.

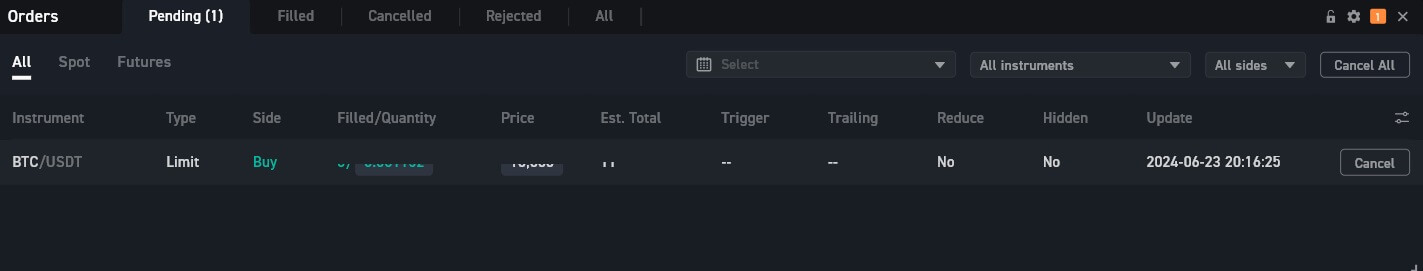

5. Once the market price of BTC reaches the price you set, the limit order will be completed. Check your completed transaction by scrolling down and clicking [Order History].

How to Trade Spot on WOO X (App)

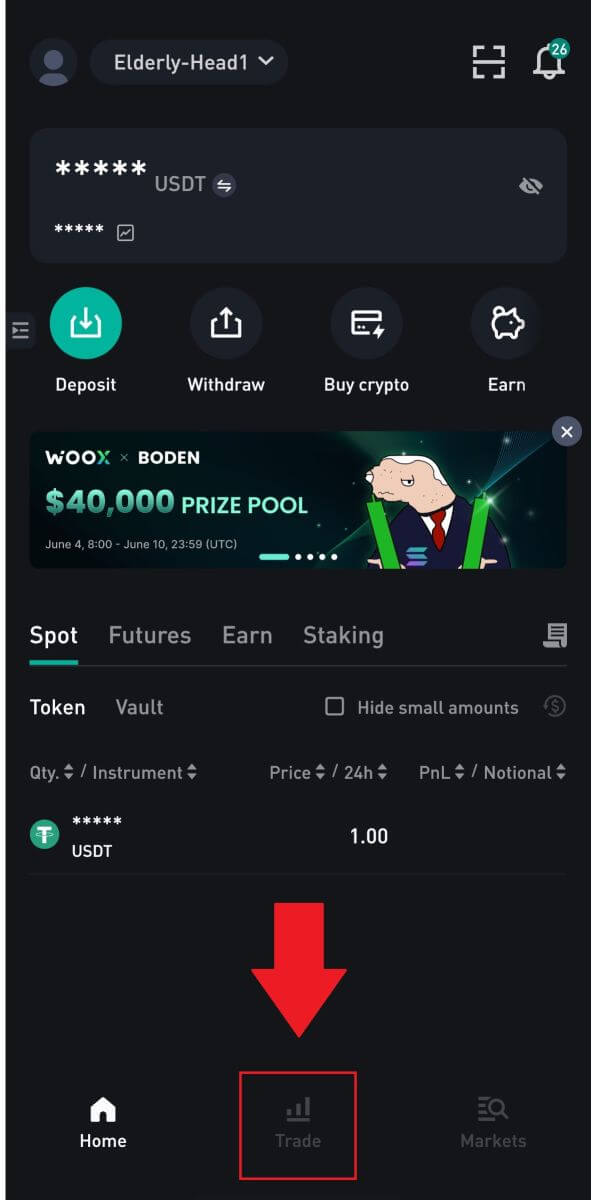

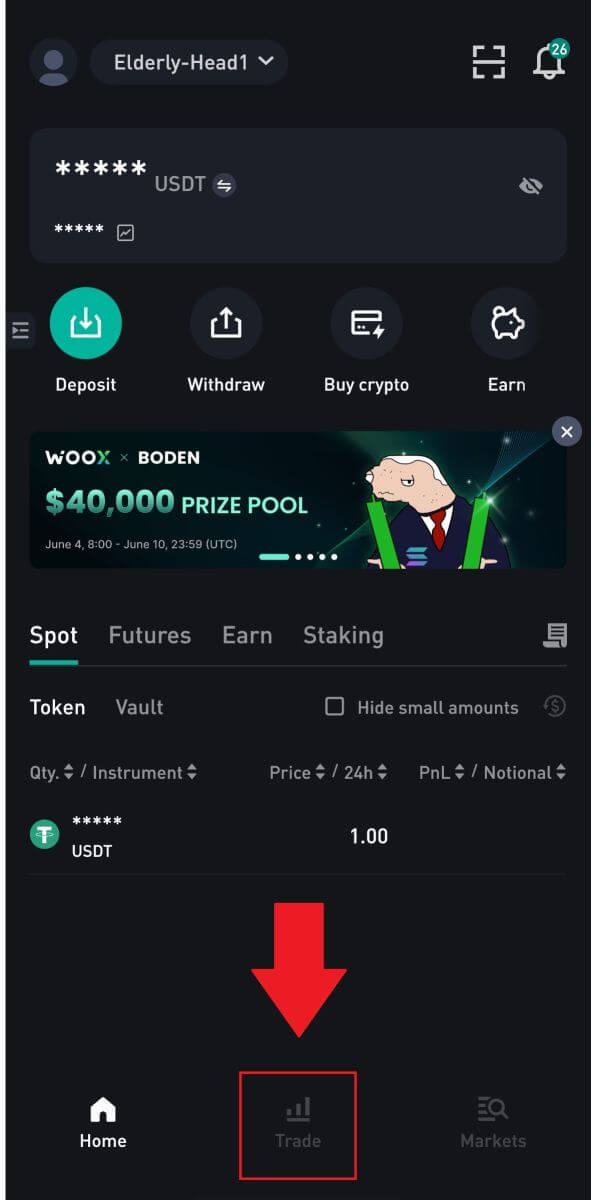

1. On your WOO X App, tap [Trade] on the bottom to head to the spot trading interface.

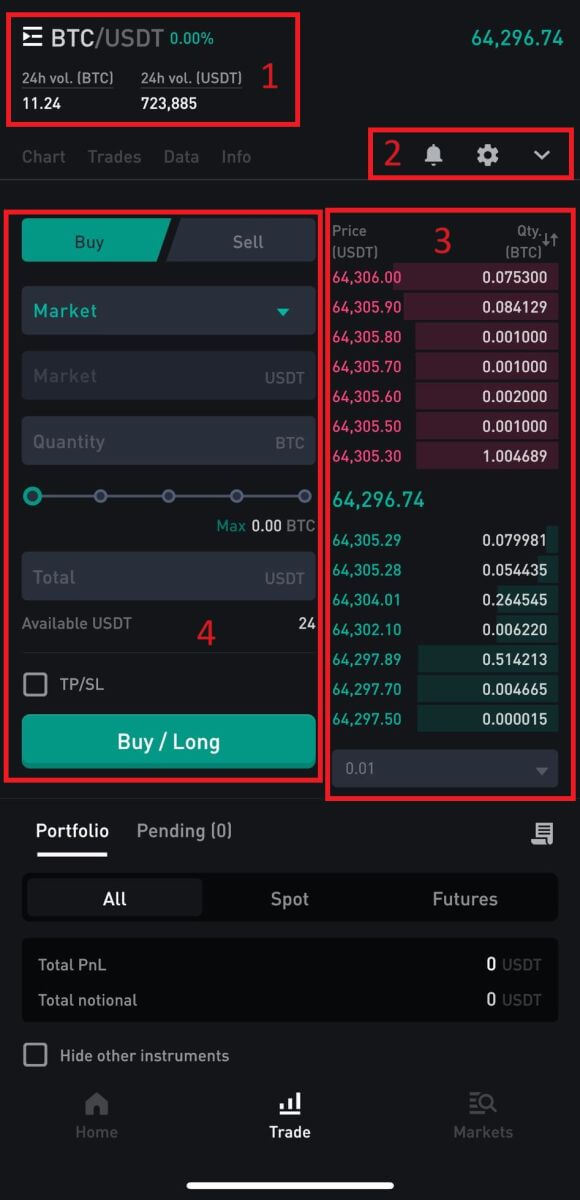

2. Here is the trading page interface.

1. Market and Trading pairs:

Spot pairs are trading pairs where transactions are settled "on the spot," meaning they are executed immediately at the current market price.

2. Real-time market candlestick chart, supported trading pairs of the cryptocurrency, “Buy Crypto” section:

Candlestick charts visually represent the price movement of a financial instrument, such as a cryptocurrency, over a specific period of time. Each candlestick typically shows the open, high, low, and close prices for that time frame, allowing traders to analyze price trends and patterns.

3. Sell/Buy Order Book:

The order book is a real-time list of buy and sell orders for a particular trading pair. It displays the quantity and price of each order, allowing traders to gauge market sentiment and liquidity.

4. Buy/Sell Cryptocurrency:

This section provides traders with the interface to place market orders, where orders are executed immediately at the current market price, or limit orders, where traders specify the price at which they want their order to be executed.

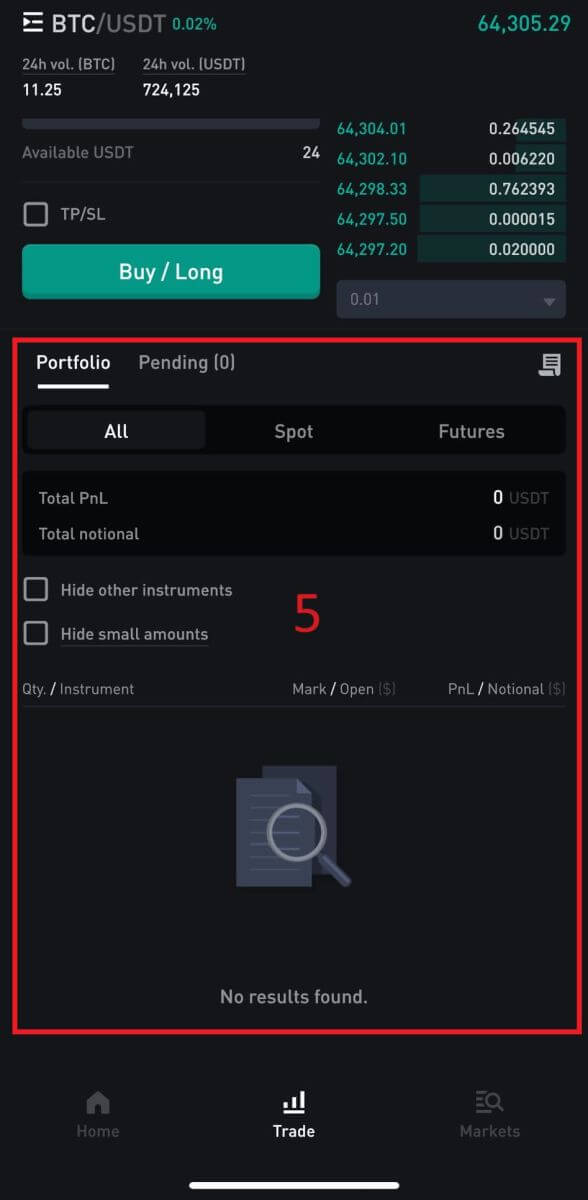

5. Porfortlio and Order Information:

This section displays the trader’s recent trading activity, including executed trades and open orders that have not yet been filled or canceled. It typically shows details such as order type, quantity, price, and time of execution.

For example, we will make a [Limit order] trade to buy BTC.

1. Log in to your WOO X app and tap on [Trade].

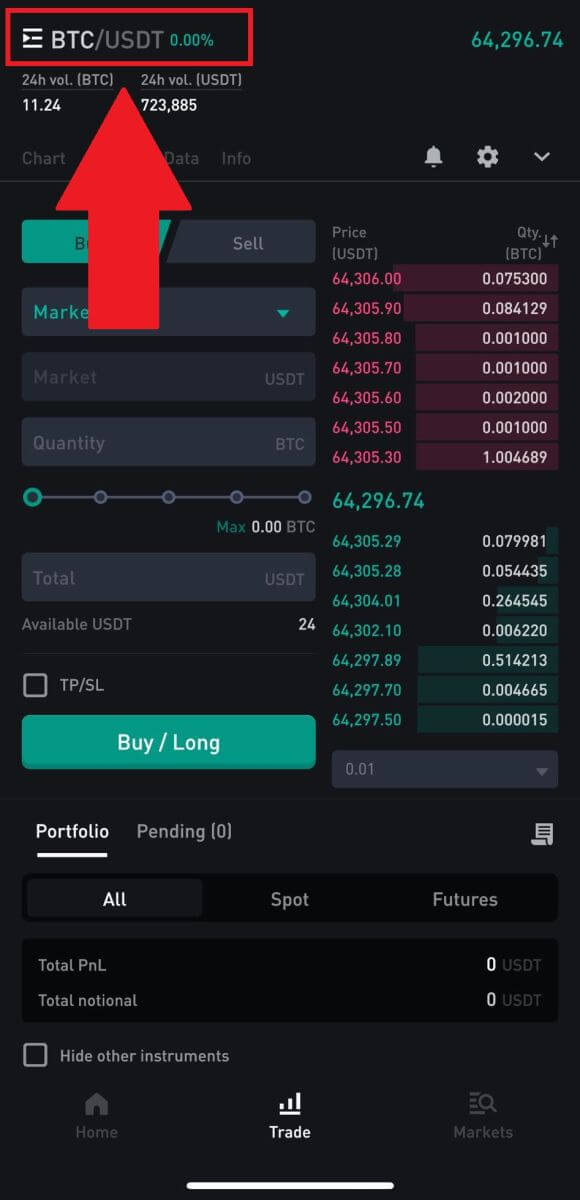

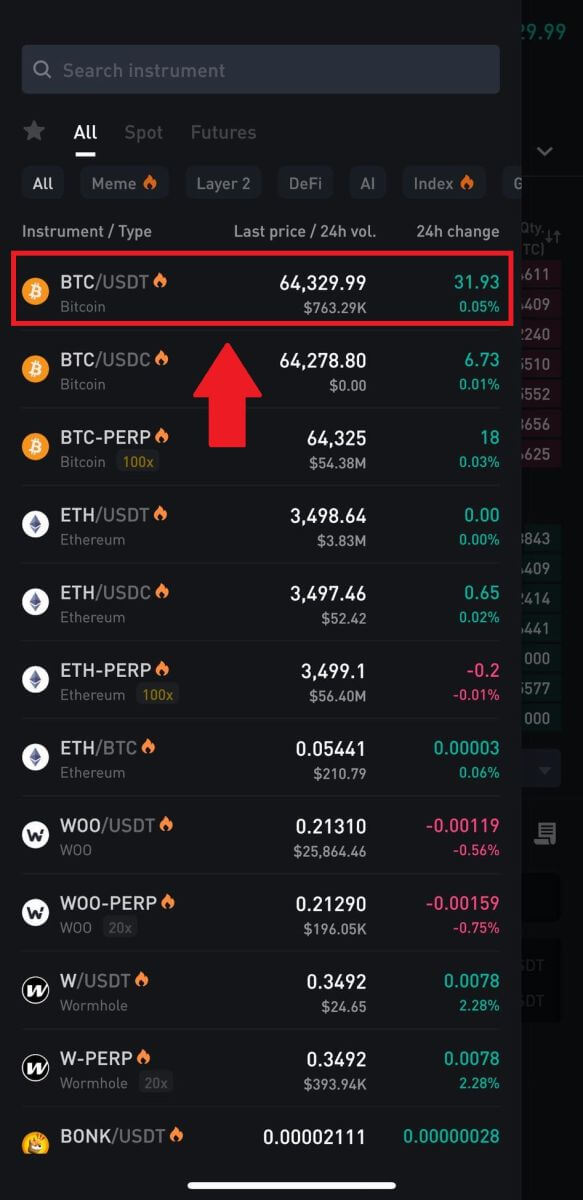

2. Click the [lines] menu button to show available trading pairs and choose BTC/USDT from the market watchlist.

2. Click the [lines] menu button to show available trading pairs and choose BTC/USDT from the market watchlist.

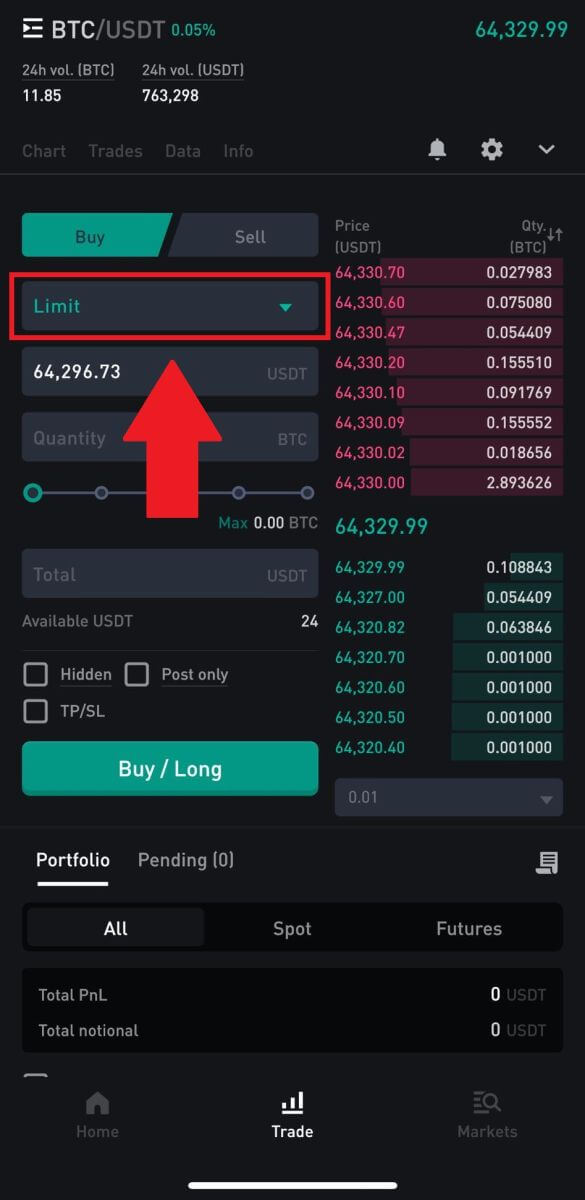

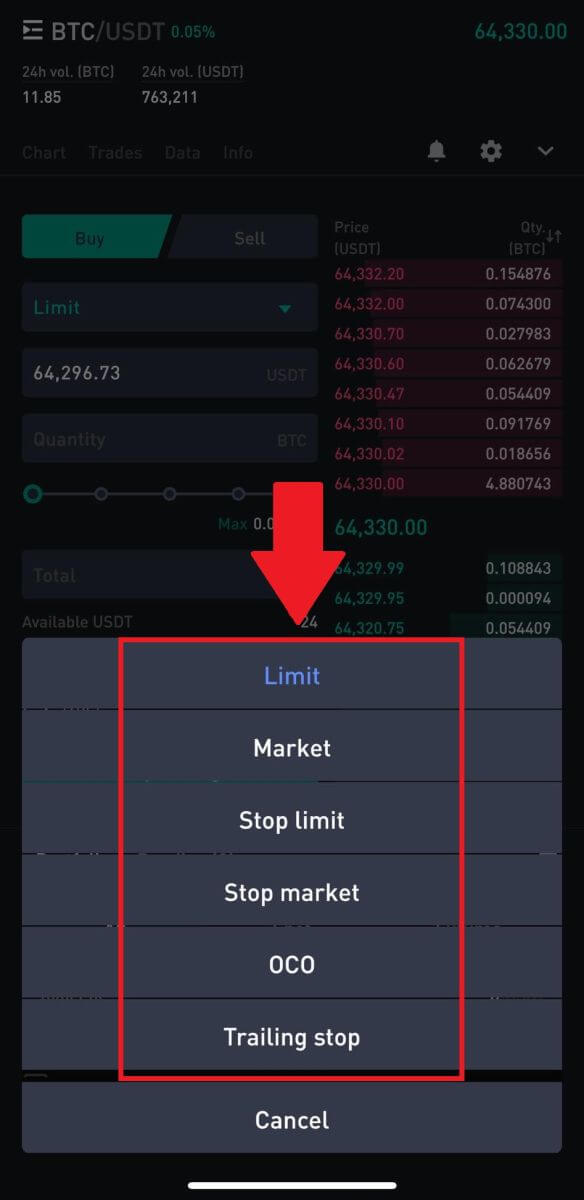

3. Go to the Buy/Sell Section. Select the type of order (we will use Limit Order as an example) in the "Limit Order" dropdown menu.

3. Go to the Buy/Sell Section. Select the type of order (we will use Limit Order as an example) in the "Limit Order" dropdown menu.

-

Limit Order allows you to place an order to buy or sell crypto for a specific price;

-

Market Order allows you to buy or sell crypto for the current real-time market price;

-

Users can also utilize advanced features such as "Stop Limit", "Stop Market", "OCO" and "Trailing Stop" to make orders. Input the BTC amount you want to buy, and the expenses of USDT will be displayed accordingly.

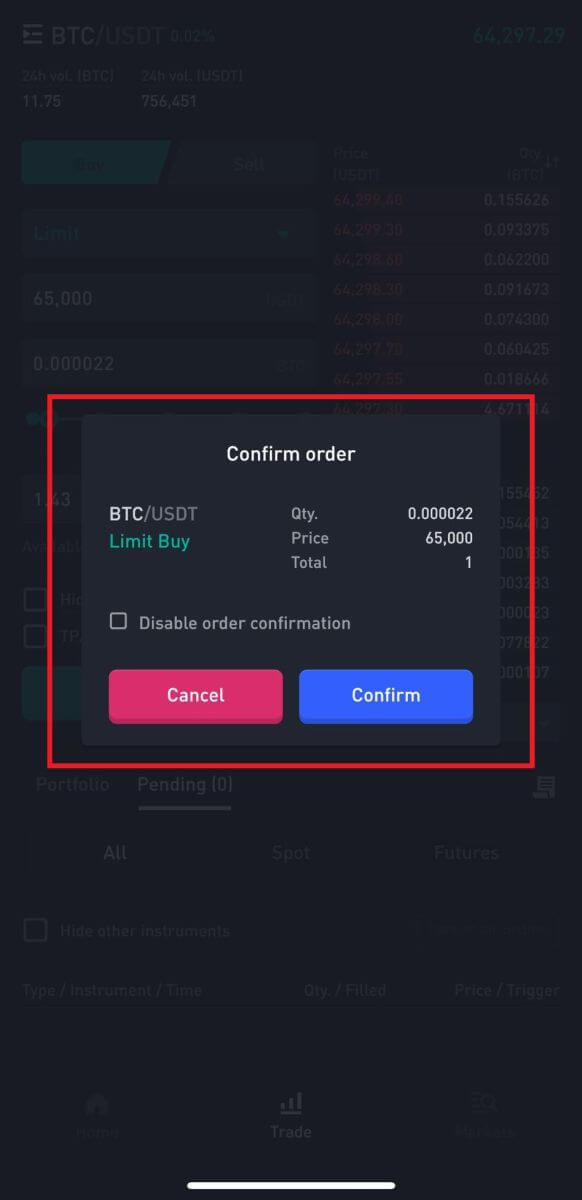

4. Review your order, then click [Confirm] and wait for the trade to be processed.

4. Review your order, then click [Confirm] and wait for the trade to be processed.

5. Once the market price of BTC reaches the price you set, the limit order will be completed. Check your completed transaction by scrolling down and clicking [Order History].

Frequently Asked Questions (FAQ)

Different Order Types in Spot Trading

1. Limit Order

A limit order refers to a user-defined order in which they specify the quantity and maximum bid or minimum ask price. The order will only be executed when the market price falls within the designated price range:

• The buy limit price must not exceed 110% of the last price.

• The sell limit price must not be 90% less than the last price.

2. Market Order

A market order refers to a user executing buy or sell orders instantly at the prevailing best market price in the current market, aiming for a swift and fast transaction.

3. Stop-Limit Order

Stop-Limit orders involve the user pre-setting the trigger price, order price, and quantity of orders. When the market price reaches the trigger price, the system will automatically execute orders based on the pre-determined order price and quantity, assisting the user in preserving profits or minimizing losses.

• The buy stop-limit price must not exceed 110% of the trigger price.

• The sell stop-limit price must not be less than 90% of the trigger price.

4. Trailing Stop Order

In the case of a significant market callback, a Trailing Stop Order will be activated and sent to the market at the current market price once the last filled price hits the specified trigger price and the required callback ratio is satisfied.

To put it simply, when executing a buy order, the last filled price must be less than or equal to the trigger price, and the callback range must be higher than or equal to the callback ratio. In this case, the buy order will be made at the market price. For a sell order, the last filled price must be higher than or equal to the trigger price, and the callback range must be higher than or equal to the callback ratio. The sell order will then be executed at the market price.

To prevent users from inadvertently placing orders that could result in avoidable losses, WOO X has implemented the following restrictions on Trailing Stop order placement:

- For a buy order, the trigger price cannot be higher than or equal to the last filled price.

- For a sell order, the trigger price cannot be less than or equal to the last filled price.

- The callback ratio limitation: it can be set within a range of 0.01% to 10%.

What Is the Difference Between Spot Trading and Traditional Fiat Trading?

In traditional fiat trading, digital assets are exchanged for fiat currencies like the RMB (CNY). For example, if you buy Bitcoin with RMB and its value increases, you can exchange it back for more RMB, and vice versa. For instance, if 1 BTC equals 30,000 RMB, you could purchase 1 BTC and sell it later when its value rises to 40,000 RMB, thus converting 1 BTC into 40,000 RMB.

However, in WOO X spot trading, BTC serves as the base currency instead of fiat currency. For instance, if 1 ETH is equivalent to 0.1 BTC, you can buy 1 ETH with 0.1 BTC. Then, if the value of ETH increases to 0.2 BTC, you can sell 1 ETH for 0.2 BTC, effectively exchanging 1 ETH for 0.2 BTC.

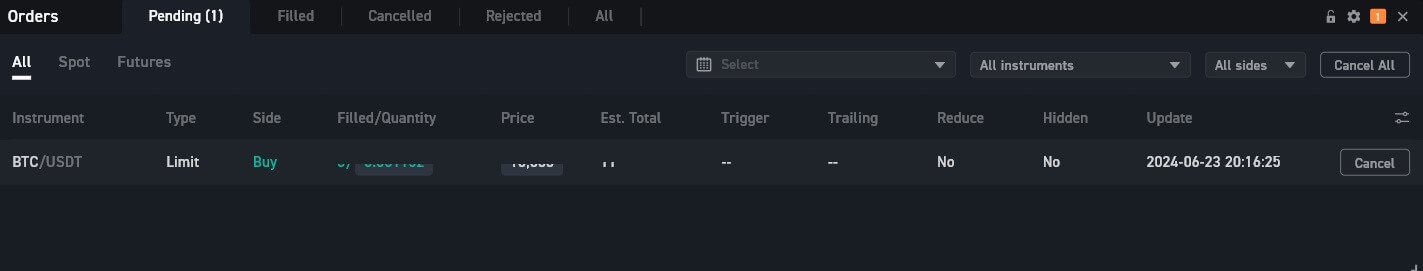

How to View my Spot Trading Activity

You can view your spot trading activities from the Orders and Positions panel at the bottom of the trading interface. Simply switch between the tabs to check your open order status and previously executed orders.

How to Withdraw from WOO X

How to Withdraw Crypto from WOO X

Withdraw Crypto from WOO X (Web)

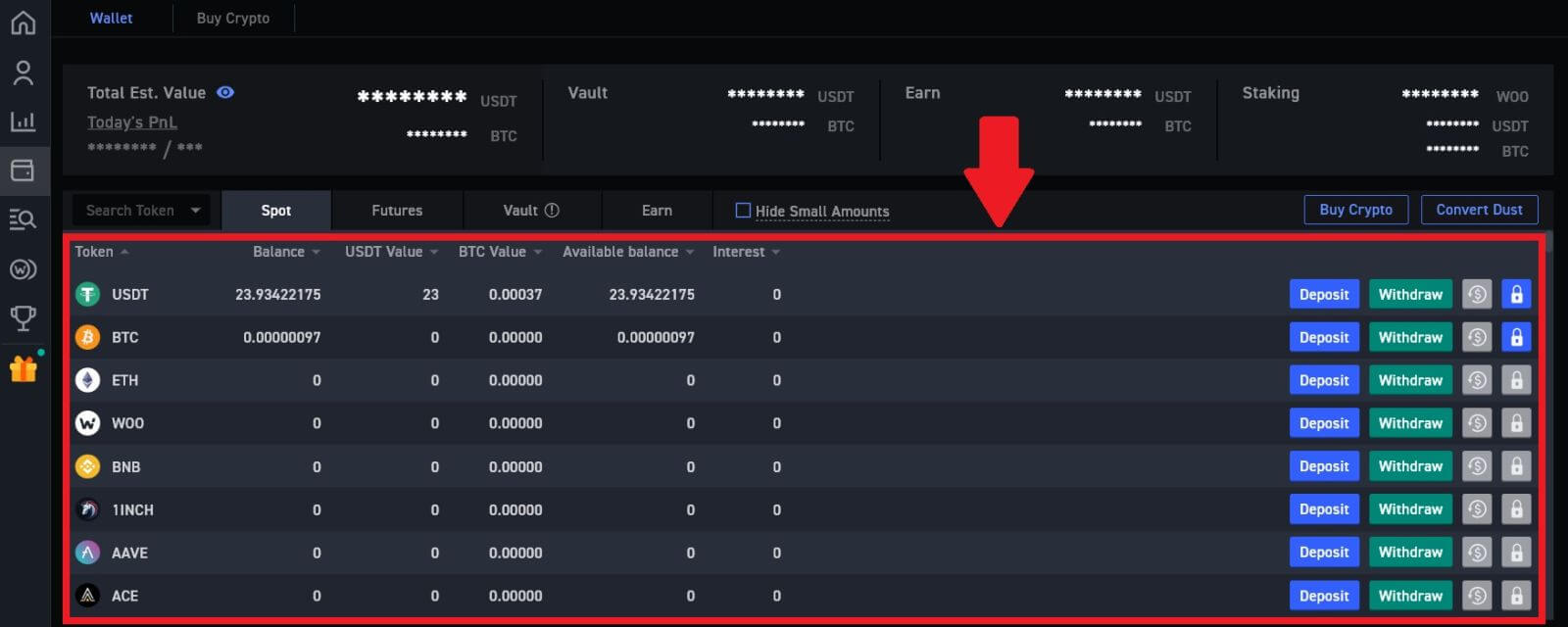

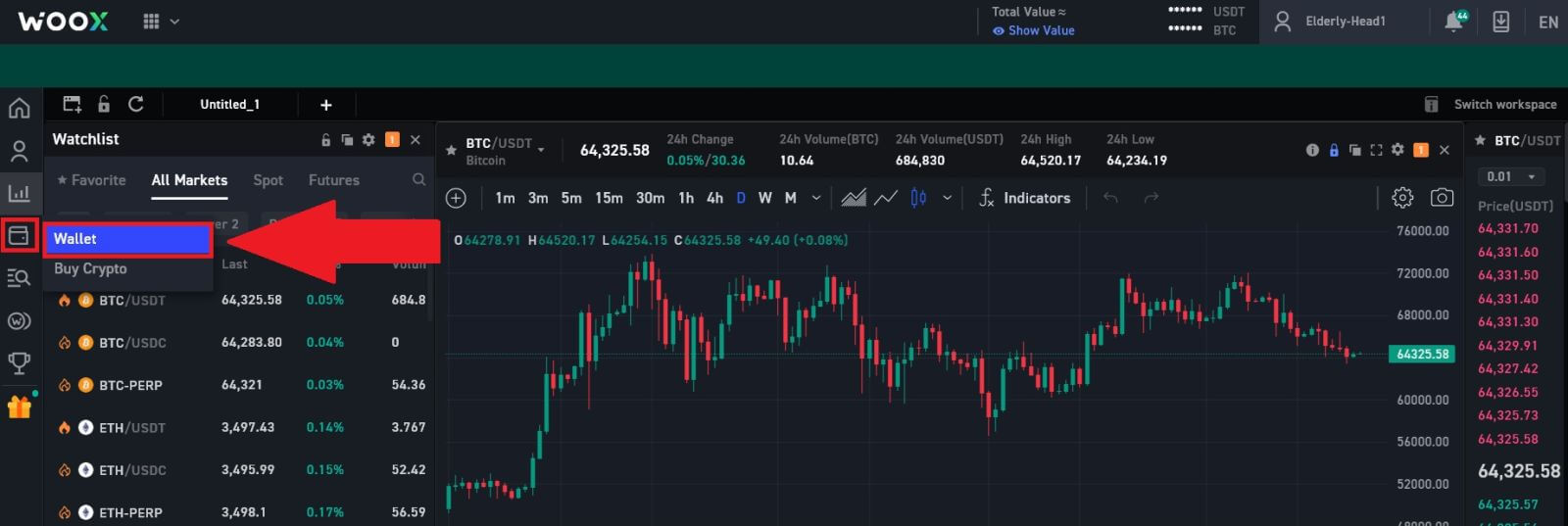

1. Log in to your WOO X account and click on [Wallet].

2. Select the token that you want to withdraw, then click [Withdraw] to continue the process.

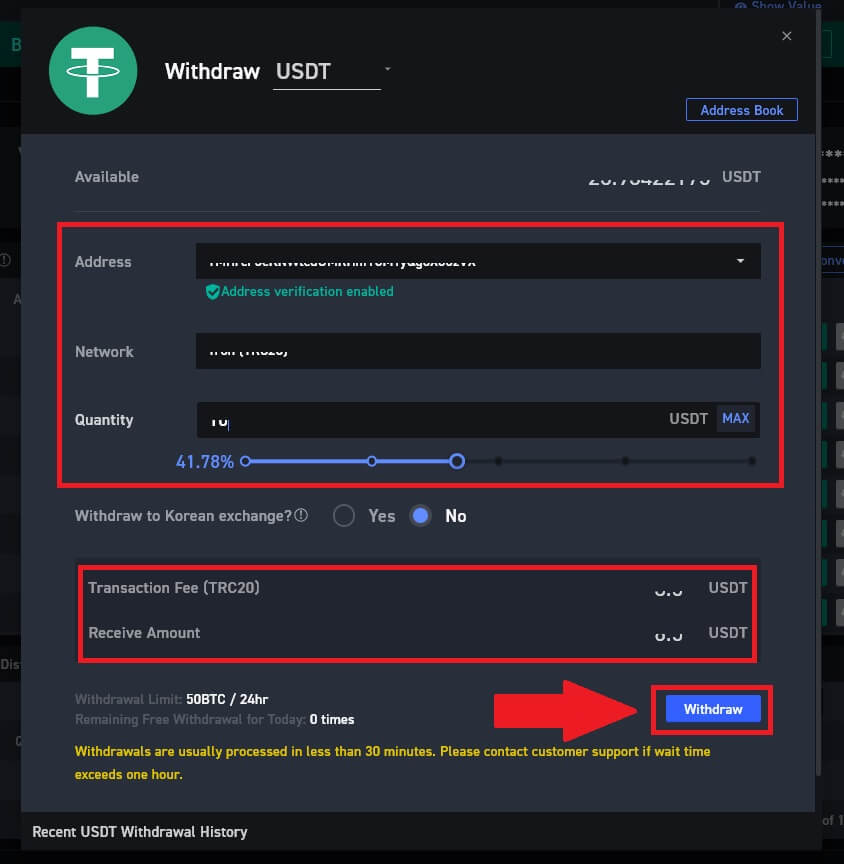

3. Enter your withdrawal address and network, fill out the quantity that you want to withdraw. Then review your transaction and click [Withdraw].

Warning: Please make sure that the selected network is the same as the network of the platform you are depositing crypto to. If you select the wrong network, you will lose your funds.

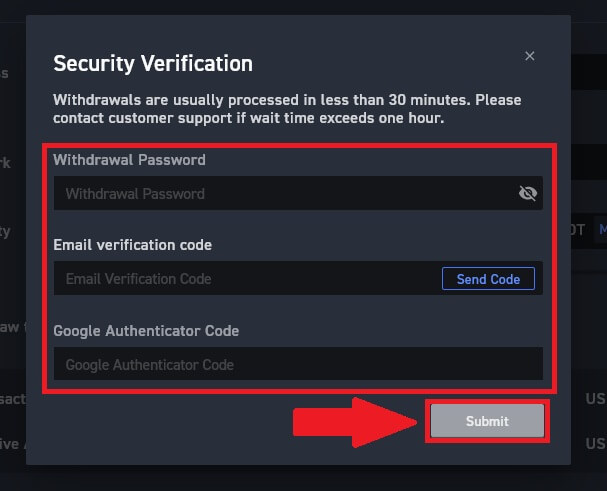

4. Enter your Withdrawal Password, input your email verification code by clicking on [Get Code] and filling up your Google Authenticator code, then click [Submit].

5. After that, you have successfully withdrawn crypto from WOO X.

You can check your recent transactions by clicking on [View History].

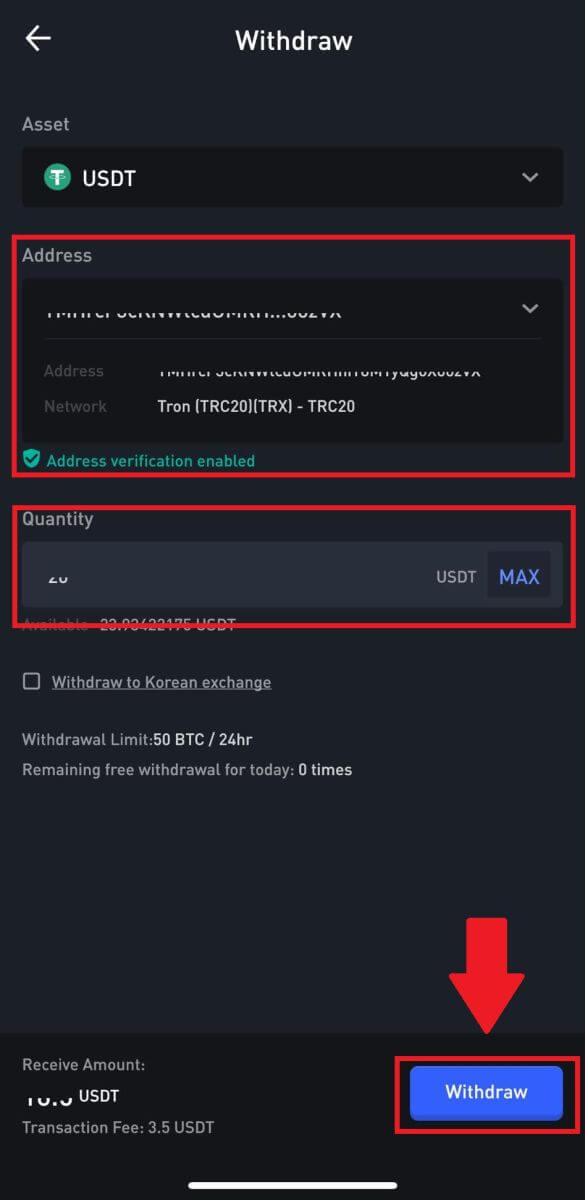

Withdraw Crypto from WOO X (App)

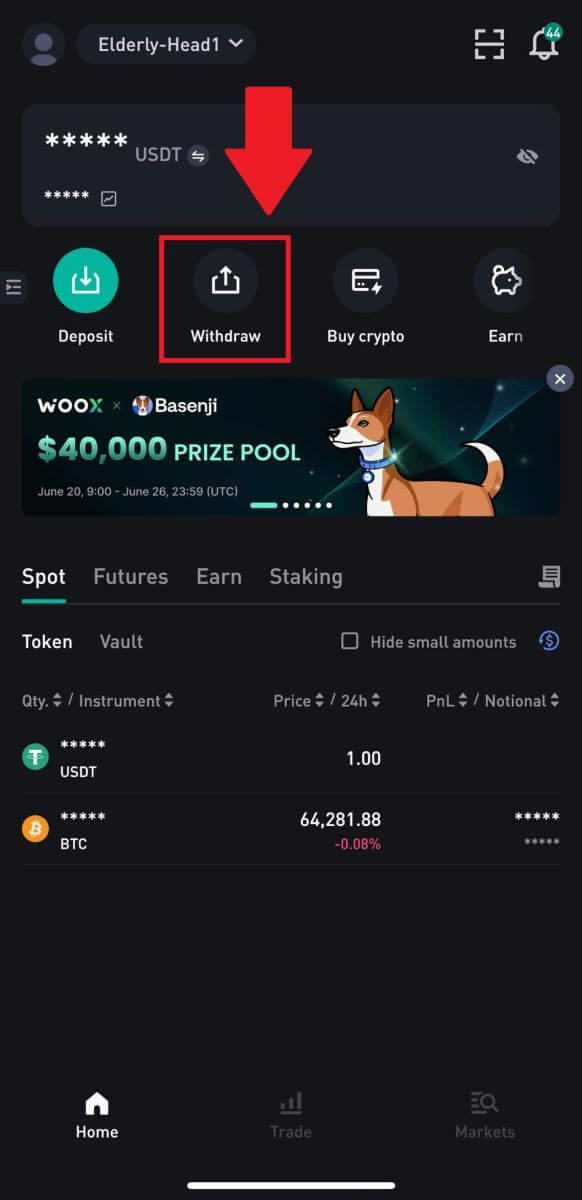

1. Open your WOO X app and tap on [Withdraw] on the first page.

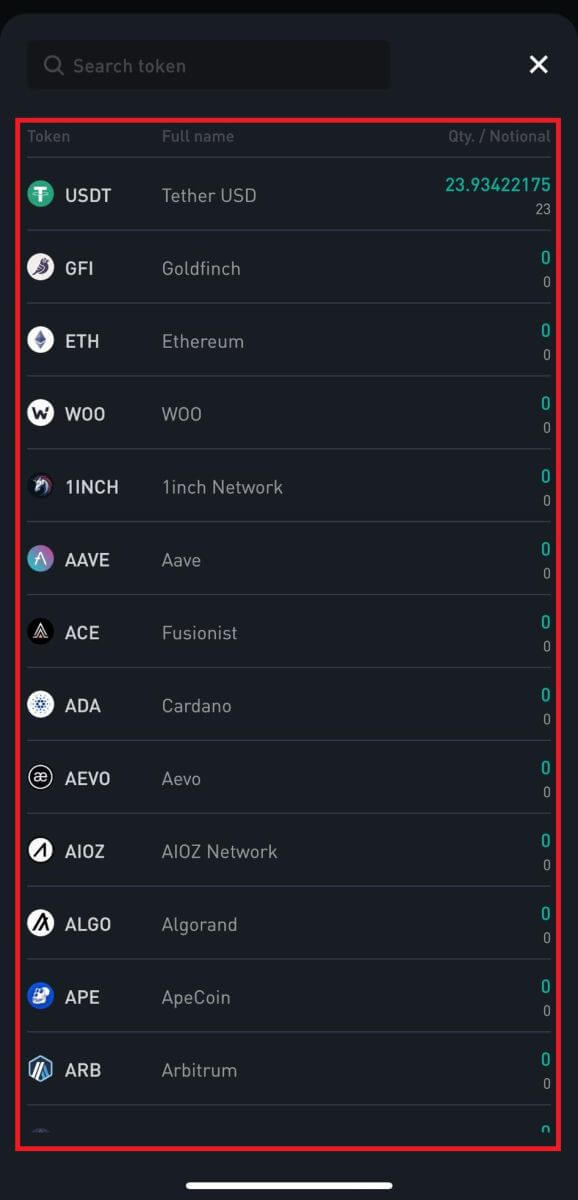

2. Select the token that you want to withdraw to continue. Here, we’re using USDT as an example.

3. Select the address that have been added to your address book, enter the quantity that you wish to withdraw and tap [Withdraw].

Warning: Please make sure that the selected network is the same as the network of the platform you are depositing crypto to. If you select the wrong network, you will lose your funds.

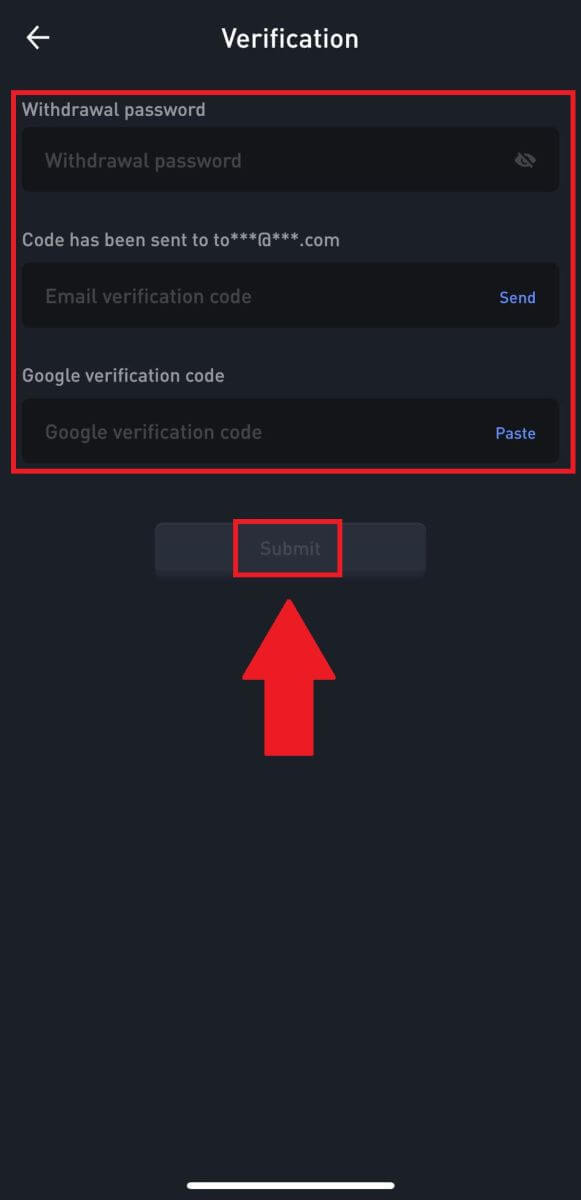

4. Enter your Withdrawal Password, input your email verification code by tapping on [Get Code] and filling up your Google Authenticator code, then press [Submit].

5. After that, you have successfully withdrawn crypto from WOO X.

5. After that, you have successfully withdrawn crypto from WOO X.

You can check your recent transactions by clicking on [View History].

Frequently Asked Questions (FAQ)

Why hasn’t my withdrawal arrived?

Transferring funds involves the following steps:

- Withdrawal transaction initiated by WOO X.

- Confirmation of the blockchain network.

- Depositing on the corresponding platform.

Normally, a TxID (transaction ID) will be generated within 30–60 minutes, indicating that our platform has successfully completed the withdrawal operation and that the transactions are pending on the blockchain.

However, it might still take some time for a particular transaction to be confirmed by the blockchain and, later, by the corresponding platform.

Due to possible network congestion, there might be a significant delay in processing your transaction. You may use the transaction ID (TxID) to look up the status of the transfer with a blockchain explorer.

- If the blockchain explorer shows that the transaction is unconfirmed, please wait for the process to be completed.

- If the blockchain explorer shows that the transaction is already confirmed, it means that your funds have been sent out successfully from WOO X, and we are unable to provide any further assistance on this matter. You will need to contact the owner or support team of the target address and seek further assistance.

Important Guidelines for Cryptocurrency Withdrawals on WOO X Platform

- For crypto that support multiple chains such as USDT, please make sure to choose the corresponding network when making withdrawal requests.

- If the withdrawal crypto requires a MEMO, please make sure to copy the correct MEMO from the receiving platform and enter it accurately. Otherwise, the assets may be lost after the withdrawal.

- After entering the address, if the page indicates that the address is invalid, please check the address or contact our online customer service for further assistance.

- Withdrawal fees vary for each crypto and can be viewed after selecting the crypto on the withdrawal page.

- You can see the minimum withdrawal amount and withdrawal fees for the corresponding crypto on the withdrawal page.

How do I check the transaction status on the blockchain?

1. Log in to your WOO X account and click on [Wallet].

2. Scroll down and here you can view your transaction status.